Starting with What Is a Balloon Payment Loan and Should You Get One?, this introduction aims to grab the readers’ attention and provide a sneak peek into the world of balloon payment loans.

The following paragraphs will delve deeper into the intricacies of balloon payment loans, shedding light on their pros, cons, eligibility criteria, and much more.

Understanding Balloon Payment Loans

A balloon payment loan is a type of loan that requires the borrower to make a large payment at the end of the loan term. These payments are much larger than the regular monthly payments made throughout the loan term.

Typical Terms for Balloon Payment Loans

- Loan Term: Balloon payment loans typically have shorter terms ranging from 5 to 7 years.

- Low Monthly Payments: Monthly payments are lower compared to traditional loans because they do not cover the full loan amount.

- Large Balloon Payment: At the end of the loan term, the borrower is required to make a lump sum payment to cover the remaining balance.

Differences from Traditional Loans

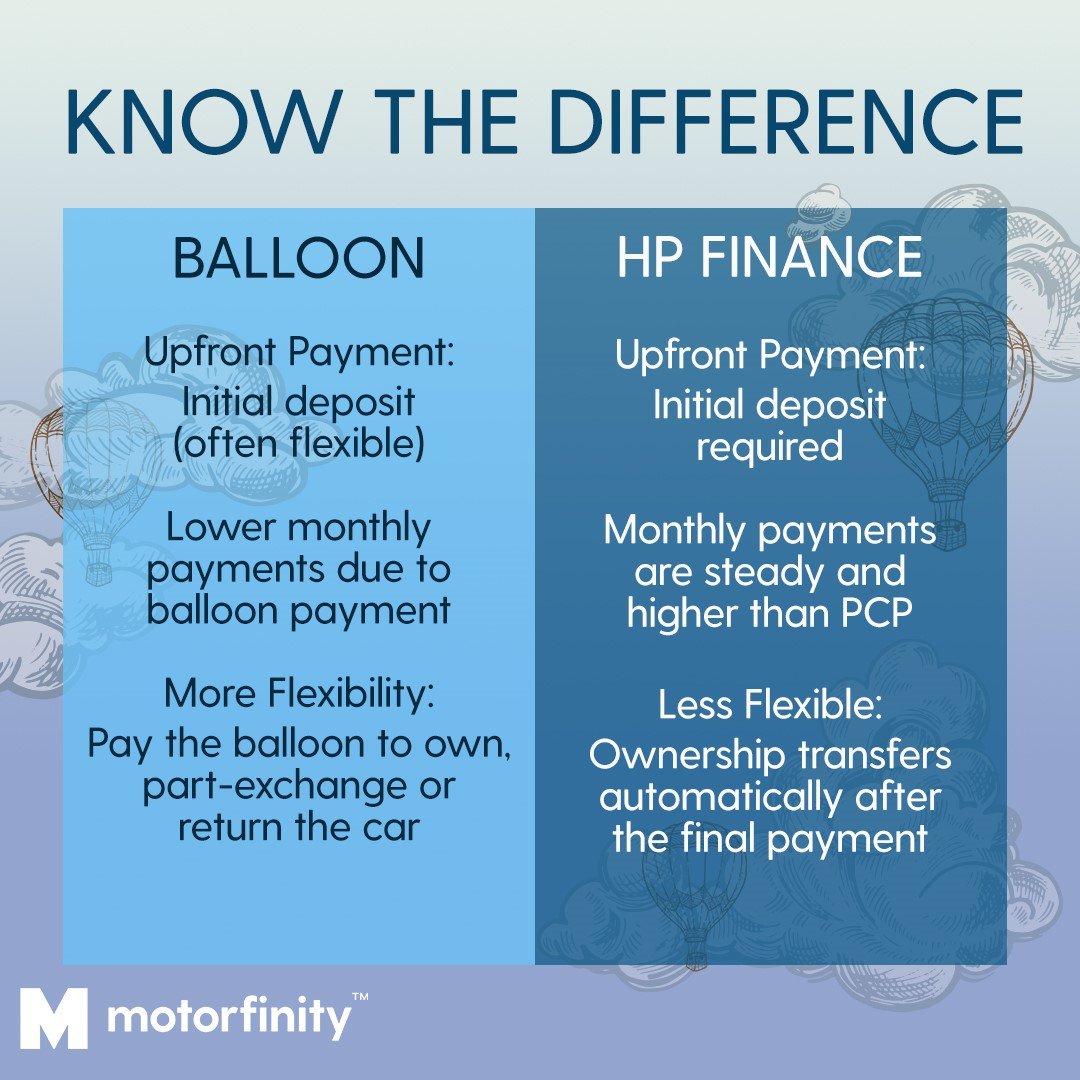

- Payment Structure: Balloon payment loans have lower monthly payments but require a large final payment, whereas traditional loans have equal monthly payments throughout the term.

- Risk: There is a higher risk associated with balloon payment loans as borrowers may struggle to make the large final payment, leading to potential financial difficulties.

- Homeownership: Balloon payment loans are more commonly used for real estate transactions where the borrower plans to sell or refinance the property before the balloon payment is due.

Pros and Cons of Balloon Payment Loans

When considering a balloon payment loan, it is essential to weigh both the advantages and disadvantages to make an informed decision.

Advantages of Balloon Payment Loans

- Lower Monthly Payments: Balloon payment loans typically have lower monthly payments compared to traditional loans, making them attractive to borrowers with fluctuating income.

- Flexibility: These loans offer flexibility in terms of repayment schedules, allowing borrowers to tailor the loan to their specific financial situation.

- Potential for Investment: Balloon payment loans can be beneficial for borrowers who plan to sell or refinance the property before the balloon payment is due, potentially allowing them to benefit from appreciation in property value.

Disadvantages of Balloon Payment Loans

- Risk of Refinancing: There is a risk of being unable to refinance the balloon payment when it comes due, which could lead to financial strain or even foreclosure.

- Uncertainty: Borrowers face uncertainty with balloon payment loans, as they must be prepared to make a substantial payment at the end of the loan term, which may be challenging if financial circumstances change.

- Interest Rate Fluctuations: Balloon payment loans are often associated with adjustable interest rates, which can lead to unpredictable changes in monthly payments and overall costs.

Comparison with Other Types of Loans

- Compared to Fixed-Rate Loans: Balloon payment loans may offer lower initial interest rates, but they come with the risk of a large lump sum payment at the end of the term, unlike fixed-rate loans that provide certainty in monthly payments.

- Compared to Adjustable-Rate Mortgages (ARMs): While both balloon payment loans and ARMs have adjustable interest rates, balloon payment loans require a lump sum payment at the end, whereas ARMs adjust periodically throughout the loan term.

- Compared to Interest-Only Loans: Balloon payment loans differ from interest-only loans in that interest-only loans allow borrowers to delay paying down the principal, while balloon payment loans require the full principal repayment at the end of the term.

Eligibility Criteria for Balloon Payment Loans

When it comes to qualifying for a balloon payment loan, lenders typically have specific requirements that borrowers must meet in order to be eligible for this type of financing. These requirements can vary depending on the lender, but there are some common factors that are often considered.

Financial Factors Considered by Lenders

- Income Level: Lenders will assess your income to determine if you have the financial means to make the large balloon payment at the end of the loan term. They want to ensure that you have a stable income that can support this payment.

- Credit Score: Your credit score plays a significant role in determining your eligibility for a balloon payment loan. Lenders use your credit score to evaluate your creditworthiness and assess the risk of lending to you.

- Debt-to-Income Ratio: Lenders will also look at your debt-to-income ratio, which is the percentage of your monthly income that goes towards paying off debt. A lower debt-to-income ratio indicates that you have more financial resources available to make the balloon payment.

- Collateral: In some cases, lenders may require collateral to secure the loan, especially if you have a lower credit score. This can be in the form of property or other valuable assets.

How Balloon Payments Work

When it comes to balloon payment loans, the payment structure is quite different from traditional loans. In a balloon payment loan, borrowers make smaller monthly payments throughout the loan term, with a large “balloon” payment due at the end.

This final balloon payment is typically significantly larger than the monthly payments made throughout the loan term. It consists of the remaining principal amount, plus any interest that has accrued over the loan term. Borrowers must be prepared to pay this lump sum at the end of the loan term.

Breakdown of Payments

- Each month, borrowers make smaller payments that cover the interest accrued and a portion of the principal amount.

- These monthly payments are lower than what they would be in a traditional loan, as they do not fully amortize the loan.

- At the end of the loan term, the final balloon payment is due, which includes the remaining principal balance.

It’s important for borrowers to have a plan in place to cover the large balloon payment at the end of the loan term.

Implications for Borrowers

- Borrowers need to be prepared financially for the final balloon payment, which can be quite substantial.

- If borrowers are unable to make the balloon payment, they may need to refinance the loan or sell the asset to cover the amount.

- Some borrowers may choose balloon payment loans if they expect to have the means to make the final payment or if they plan to sell the asset before the balloon payment is due.

Choosing Between Balloon Payment Loans and Traditional Loans

When deciding between balloon payment loans and traditional loans, it is essential to consider various factors to determine which option best suits your financial situation.

Comparing Features

- Balloon Payment Loans:

- Lower initial monthly payments compared to traditional loans.

- Large lump sum payment due at the end of the loan term.

- Shorter loan terms typically ranging from 5 to 7 years.

- Traditional Loans:

- Fixed-rate or adjustable-rate mortgages available.

- Longer loan terms ranging from 15 to 30 years.

- Higher initial monthly payments but no balloon payment.

Scenarios for Balloon Payment Loans

Balloon payment loans may be a suitable choice for individuals who:

- Plan to sell or refinance the property before the balloon payment is due.

- Expect a significant increase in income before the balloon payment comes into effect.

- Are looking for a short-term financing option with lower initial payments.

When Traditional Loans Are Preferred

Traditional loans might be a better option in the following scenarios:

- Individuals seeking long-term stability and predictability in monthly payments.

- Homebuyers planning to stay in the property for an extended period.

- Borrowers who prefer to avoid the risk of a large balloon payment at the end of the loan term.

Risks and Considerations for Borrowers

When considering a balloon payment loan, borrowers need to be aware of the potential risks involved and carefully evaluate their financial situation to ensure they can manage the loan effectively.

Risk of Payment Shock

One of the main risks associated with balloon payment loans is the potential for payment shock. This occurs when the borrower is required to make a large lump sum payment at the end of the loan term, which can be significantly higher than their regular monthly payments.

To manage this risk, borrowers should carefully budget and plan for the balloon payment well in advance. It’s important to set aside funds or explore refinancing options to avoid financial strain when the balloon payment becomes due.

Interest Rate Fluctuations

Another risk of balloon payment loans is the potential for interest rate fluctuations. If interest rates rise significantly before the balloon payment is due, borrowers may face higher overall costs than anticipated.

To mitigate this risk, borrowers can consider fixed-rate balloon payment loans or monitor interest rate trends to make informed decisions about when to refinance or pay off the loan early.

Property Value Changes

Changes in property values can also pose a risk for borrowers with balloon payment loans. If the value of the property decreases significantly, borrowers may have difficulty refinancing or selling the property to cover the balloon payment.

To address this risk, borrowers should stay informed about market trends and consider options such as property improvements to maintain or increase the value of their assets.

Refinancing Challenges

When the balloon payment becomes due, borrowers may face challenges in refinancing the loan if their financial situation has changed or if market conditions are unfavorable. Lenders may be less willing to extend new financing if the borrower’s circumstances have deteriorated.

To navigate this challenge, borrowers should maintain a good credit score, keep debt levels manageable, and establish a strong financial profile to increase their chances of securing refinancing options when needed.

Impact of Balloon Payment Loans on Financial Planning

When considering balloon payment loans, it is crucial to understand how they can impact your long-term financial goals. These types of loans can have both positive and negative effects on your overall financial plan, depending on how they are managed.

Incorporating Balloon Payments into a Comprehensive Financial Plan

- Develop a detailed budget: Create a comprehensive budget that accounts for the balloon payment due at the end of the loan term. This will help you allocate funds accordingly and avoid financial strain when the payment is due.

- Set aside savings: Start saving early to ensure you have enough funds to cover the balloon payment when it comes due. Consider setting up a separate savings account specifically for this purpose.

- Consider refinancing options: Explore the possibility of refinancing the balloon payment into a traditional loan or mortgage to spread out the payments over a longer term.

Preparing for Balloon Payments Effectively

- Evaluate your financial situation: Understand your current financial standing and assess whether you will be able to afford the balloon payment when it becomes due.

- Seek financial advice: Consult with a financial advisor to get expert guidance on how to incorporate balloon payments into your overall financial plan and make informed decisions.

- Create a repayment strategy: Develop a repayment strategy that aligns with your financial goals and ensures you can meet the balloon payment obligation without jeopardizing your financial stability.

Refinancing and Alternatives to Balloon Payments

Refinancing a balloon payment loan involves replacing the current loan with a new loan, typically with a longer term and fixed monthly payments. This can help borrowers manage the large balloon payment due at the end of the loan term.

Alternative options for borrowers facing balloon payments include negotiating with the lender for an extension, selling the asset to cover the balloon payment, or seeking a new loan to pay off the balloon amount. Each option has its own implications and considerations based on individual financial circumstances.

Refinancing a Balloon Payment Loan

Refinancing a balloon payment loan allows borrowers to convert the remaining balance into a new loan with more manageable monthly payments. This can help avoid the financial strain of a large lump sum payment at the end of the loan term. However, it’s important to consider the costs associated with refinancing, such as closing costs, fees, and potentially higher interest rates.

Alternative Options for Borrowers

- Extension Negotiation: Some lenders may be willing to extend the loan term or restructure the payment terms to help borrowers avoid a balloon payment.

- Selling the Asset: If the loan is secured by an asset, selling the asset before the balloon payment is due can help cover the outstanding amount.

- New Loan: Borrowers can also explore getting a new loan to pay off the balloon amount, either through a traditional loan or another financing option.

When to Consider Refinancing or Seeking Alternatives

- Financial Hardship: If making the balloon payment would cause financial strain, refinancing or seeking alternatives may be advisable.

- Interest Rate Changes: If interest rates have dropped since the initial loan was taken, refinancing can help secure a lower rate and save money in the long run.

- Market Conditions: Changes in the market or personal financial situation may warrant exploring refinancing or alternative options to manage the balloon payment effectively.

Legal and Regulatory Aspects of Balloon Payment Loans

When it comes to balloon payment loans, there are certain legal requirements and regulations in place to protect borrowers and ensure fair lending practices. These regulations aim to provide transparency and prevent predatory lending practices that could harm consumers.

Consumer Protection Measures

- One of the key consumer protection measures for borrowers with balloon payment loans is the requirement for lenders to clearly disclose all terms and conditions of the loan, including the presence of a balloon payment.

- Regulations may also require lenders to assess the borrower’s ability to repay the balloon payment at the end of the loan term to prevent situations of financial distress.

- In some jurisdictions, there are limits on the use of balloon payments, especially in certain types of loans or for borrowers with specific risk profiles.

Recent Changes in Laws

- Recent changes in laws affecting balloon payment loans have focused on increasing transparency and consumer protection.

- Some jurisdictions have introduced stricter requirements for lenders when offering balloon payment loans, such as additional disclosures or restrictions on balloon payment amounts.

- Updates in laws may also include provisions for borrowers to seek recourse or assistance in case of unfair practices related to balloon payments.

Case Studies and Real-Life Examples

In this section, we will delve into real-life examples and case studies to provide a better understanding of how borrowers have experienced balloon payment loans and managed them effectively.

Case Study 1: Successful Balloon Payment Loan Experience

- A family wanted to purchase a vacation home but couldn’t afford the monthly payments on a traditional mortgage. They opted for a balloon payment loan with lower monthly payments.

- By carefully planning and saving over the loan term, they were able to make the balloon payment at the end of the loan period without any financial strain.

- This case study highlights the importance of strategic financial planning and disciplined saving to successfully navigate a balloon payment loan.

Case Study 2: Challenges Faced with Balloon Payment Loan

- An individual took out a balloon payment loan to buy a luxury car, attracted by the lower initial payments.

- However, when the balloon payment became due, they were unable to refinance or sell the car for the full amount, leading to financial difficulties.

- This case study demonstrates the risks of not having a clear repayment strategy in place when opting for a balloon payment loan.

Expert Insights on Dealing with Balloon Payment Loans

- Financial advisors recommend creating a detailed repayment plan from the outset, considering all possible scenarios, such as refinancing options or selling the asset.

- Experts suggest setting aside funds each month to prepare for the balloon payment, ensuring that borrowers are financially ready when the time comes.

- Professional guidance can help borrowers make informed decisions and avoid potential pitfalls associated with balloon payment loans.

Closure

Wrapping up our discussion on balloon payment loans, it’s essential to weigh the benefits and risks carefully before deciding whether this type of loan is the right choice for you.