No-doc mortgage lenders 2025 are set to revolutionize the real estate market with their unique approach to mortgage lending. As we delve into the world of no-doc mortgages, we uncover the changing landscape and key insights that shape the future of borrowing and lending in 2025.

With a focus on innovation, risk assessment, and customer experience, the discussion around no-doc mortgage lenders 2025 promises to be both enlightening and forward-thinking.

Overview of No-Doc Mortgage Lenders in 2025

A no-doc mortgage, short for “no documentation” mortgage, is a type of loan where the borrower does not have to provide as much documentation compared to traditional mortgages. This means that borrowers may not need to show proof of income, employment history, or assets.

No-doc mortgage lenders play a significant role in the real estate market by providing options for borrowers who may not meet the strict requirements of traditional lenders. This can include self-employed individuals, freelancers, or those with non-traditional sources of income.

Evolution of No-Doc Mortgage Lenders by 2025

By 2025, no-doc mortgage lenders have evolved to offer more specialized products tailored to different borrower profiles. These lenders have developed advanced algorithms and technology to assess borrower risk more accurately, allowing them to offer competitive interest rates and terms.

- Some no-doc mortgage lenders have expanded their reach to offer loans to borrowers with lower credit scores, providing more opportunities for individuals with non-traditional credit histories.

- Technology-driven no-doc lenders have streamlined the application process, making it quicker and more efficient for borrowers to secure financing without the need for extensive documentation.

- These lenders have also focused on improving transparency and communication with borrowers, providing clear information about loan terms and requirements to ensure a smooth borrowing experience.

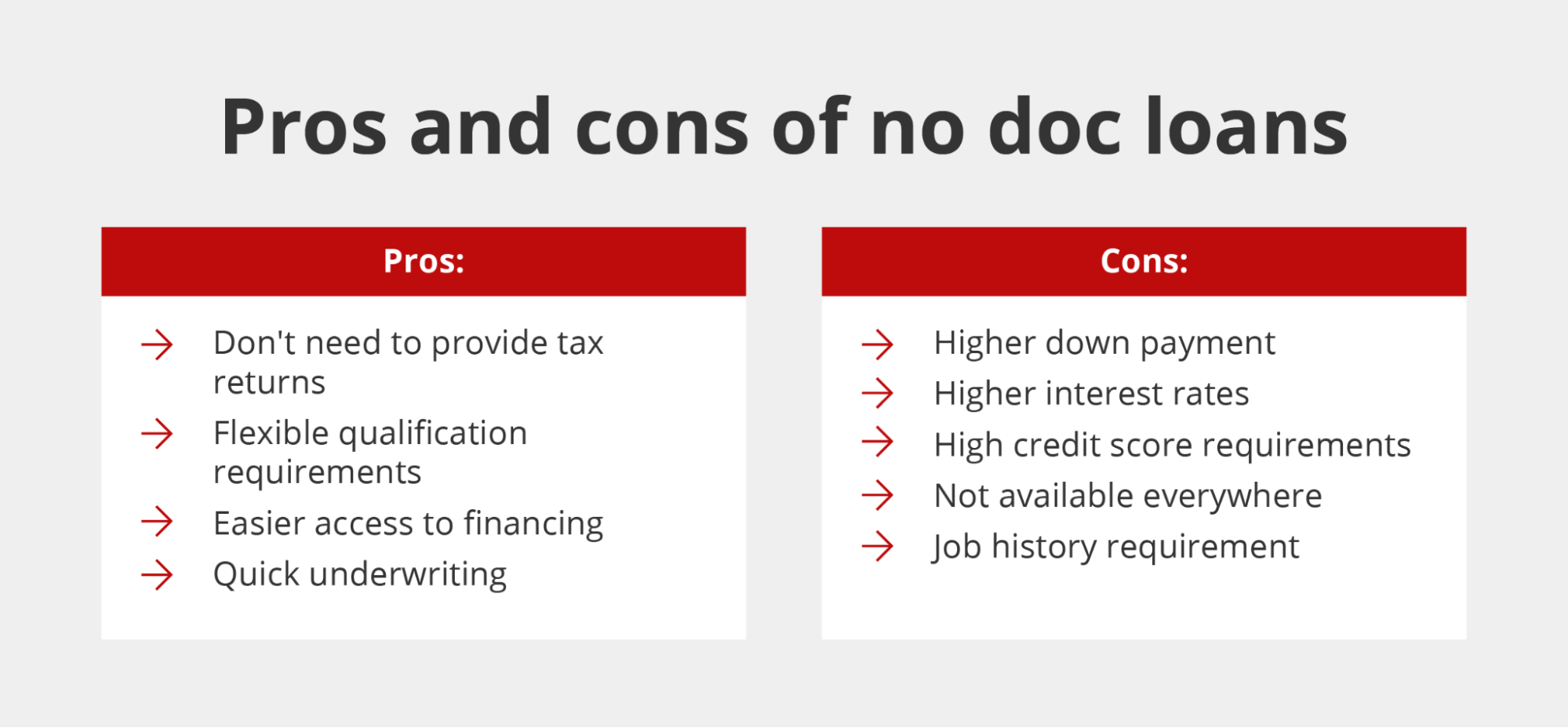

Advantages and Disadvantages of No-Doc Mortgages

When considering a no-doc mortgage, it’s important to weigh the pros and cons to make an informed decision.

Benefits of Obtaining a No-Doc Mortgage

- Streamlined application process

- Less paperwork required

- Potentially faster approval

Risks Associated with No-Doc Mortgages

- Higher interest rates

- Potential for borrowers to overstate income

- Riskier for lenders due to limited documentation

Comparison of Interest Rates

No-doc mortgages typically have higher interest rates compared to traditional mortgages due to the increased risk for lenders.

Typical Eligibility Criteria

- Good credit score

- Significant assets or reserves

- Stable employment history

Documents Not Required for No-Doc Mortgages

- Income verification documents

- Employment verification documents

- Tax returns

Evolution of No-Doc Mortgages

No-doc mortgages have evolved to include stricter eligibility criteria and safeguards to prevent abuse.

Impact on Housing Market and Economy

No-doc mortgages can lead to housing market instability if borrowers default on loans, potentially affecting the overall economy.

Financial Responsibility for Borrowers

Borrowers considering a no-doc mortgage should demonstrate a high level of financial responsibility to ensure they can afford the loan without the need for extensive documentation.

Regulatory Environment for No-Doc Mortgage Lenders

In the realm of no-doc mortgage lending, the regulatory landscape plays a crucial role in shaping how these lenders operate and the risks involved. Let’s delve into the current regulatory framework, its impact on operations, anticipated changes by 2025, comparison with traditional lenders, a timeline of regulatory evolution, and a case study exemplifying the effects of regulatory changes.

Current Regulatory Landscape for No-Doc Mortgage Lenders

No-doc mortgage lenders operate in a regulatory environment that focuses on risk management and consumer protection. The lack of documentation requirements for borrowers has led regulators to implement stringent guidelines to mitigate potential risks associated with these types of loans.

Impact of Regulations on Operations

Regulations significantly impact the operations of no-doc mortgage lenders by influencing underwriting standards, loan approval processes, and compliance requirements. These lenders must navigate complex regulatory frameworks to ensure they are operating within legal boundaries while managing risk effectively.

Anticipated Changes by 2025

By 2025, we can expect to see further tightening of regulations for no-doc mortgage lenders as regulators aim to enhance consumer protection and minimize risk in the lending industry. Increased scrutiny and transparency requirements may be implemented to safeguard against potential abuses.

Comparison with Traditional Mortgage Lenders

Compared to traditional mortgage lenders, no-doc mortgage lenders face more stringent regulatory requirements due to the higher risk nature of their lending practices. Traditional lenders typically follow more standardized documentation and verification processes to ensure borrower creditworthiness.

Evolution of Regulations Over the Past Decade

Over the past decade, regulations for no-doc mortgage lenders have evolved to address lessons learned from the financial crisis. Stricter guidelines, increased oversight, and enhanced reporting requirements have been implemented to prevent irresponsible lending practices.

Case Study on Regulatory Changes

In 2018, a regulatory change mandated that all no-doc mortgage lenders conduct thorough income verification for borrowers to prevent fraud and reduce default rates. This led to a significant decrease in loan approvals for a particular lender, impacting their market share and profitability.

Technology and Innovation in No-Doc Mortgage Lending

Technology and innovation have significantly transformed the landscape of no-doc mortgage lending, revolutionizing the way lenders process and approve loans.

Software and Platforms

Various software and platforms are commonly used in the no-doc mortgage lending process to enhance efficiency and accuracy. For instance, lenders utilize advanced loan origination systems (LOS) that streamline the application, underwriting, and approval stages. These platforms enable borrowers to submit their documentation electronically, reducing paperwork and expediting the loan approval process.

AI and Automation

The integration of artificial intelligence (AI) and automation has played a crucial role in streamlining mortgage approval for no-doc loans. Lenders leverage AI algorithms to assess borrower risk profiles, analyze financial data, and make informed lending decisions. Automation tools help in verifying information, assessing creditworthiness, and expediting loan approvals, ultimately enhancing the overall efficiency of the lending process.

Future Innovations

Looking ahead to 2025, several innovations are poised to shape the industry further. Blockchain technology is expected to revolutionize data security and transparency in mortgage transactions, ensuring tamper-proof records and reducing the risk of fraud. Biometric authentication methods, such as facial recognition or fingerprint scans, may enhance the verification process, adding an extra layer of security to loan applications. Real-time risk assessment tools powered by advanced analytics and machine learning algorithms are likely to become more prevalent, enabling lenders to assess and mitigate risks more effectively.

Machine Learning Algorithms

Machine learning algorithms have been instrumental in reducing the risk associated with no-doc loans. By analyzing vast amounts of data and identifying patterns, these algorithms help lenders make accurate lending decisions based on predictive analytics. Moreover, machine learning algorithms improve risk management practices, enhance fraud detection capabilities, and optimize the loan approval process, leading to a more secure and efficient lending environment.

Market Trends and Predictions for No-Doc Mortgage Lenders

The landscape of the mortgage industry is constantly evolving, and the demand for no-doc mortgages has been on the rise in recent years. As we look ahead to 2025, it is essential to analyze the current market trends driving this demand and make predictions about how the market share of no-doc mortgage lenders may change in the future. Additionally, exploring potential challenges and opportunities for no-doc mortgage lenders will provide valuable insights into the industry’s future direction.

Current Market Trends for No-Doc Mortgages

- The increasing number of self-employed individuals and gig economy workers seeking home financing without traditional income verification requirements is a key driver of the demand for no-doc mortgages.

- Changing consumer preferences for a more streamlined and efficient mortgage application process, coupled with advancements in technology enabling faster approval times, are also contributing to the rise in popularity of no-doc loans.

- Rising home prices and stricter lending standards in the traditional mortgage market are pushing borrowers towards alternative financing options like no-doc mortgages.

Predictions for 2025

- It is anticipated that the market share of no-doc mortgage lenders will continue to grow steadily, capturing a larger portion of the mortgage market by 2025 as more borrowers opt for these flexible loan products.

- With the increasing acceptance and normalization of alternative lending practices, traditional lenders may also start offering their own versions of no-doc mortgages to remain competitive in the evolving market landscape.

- Regulatory changes and economic conditions will play a crucial role in shaping the future of no-doc mortgage lending, influencing market trends and lender strategies in the coming years.

Challenges and Opportunities

- One of the main challenges for no-doc mortgage lenders in the future will be balancing risk management with meeting the diverse needs of borrowers, especially as the market expands and competition intensifies.

- Opportunities for growth lie in leveraging data analytics and artificial intelligence to enhance underwriting processes, improve risk assessment, and offer more personalized loan products tailored to individual borrower profiles.

- Building strong relationships with investors and ensuring compliance with evolving regulatory requirements will be crucial for no-doc mortgage lenders to navigate potential obstacles and sustain long-term success in the market.

Customer Profiles and Target Audience for No-Doc Mortgages

In the realm of no-doc mortgages, understanding the typical customers and target audience is crucial for lenders to tailor their services effectively.

Typical Customer Profiles for No-Doc Mortgages

- Entrepreneurs and self-employed individuals who have fluctuating income streams and find it challenging to provide traditional income documentation.

- Investors looking to leverage their assets for real estate investments without the hassle of extensive paperwork.

- Individuals with strong credit scores but unconventional income sources, such as freelancers or gig workers.

Target Audience of No-Doc Mortgage Lenders in 2025

- No-doc mortgage lenders in 2025 are targeting individuals who value efficiency and flexibility in the mortgage application process.

- They cater to borrowers who prioritize privacy and prefer not to disclose detailed financial information.

- The target audience also includes borrowers who may have unique financial situations that do not fit traditional lending criteria.

Reasons for Choosing No-Doc Mortgages

- Speed and convenience in the application process, with minimal paperwork and faster approval times.

- Privacy concerns for individuals who prefer to keep their financial information confidential.

- Flexibility for borrowers with non-traditional income sources or irregular payment schedules.

Comparison of Financial Profiles

- Customers opting for no-doc mortgages typically have higher credit scores but may lack traditional income documentation.

- Those choosing traditional mortgage options often have stable income sources and can provide extensive financial records.

Demographic Breakdown of Target Audience

| Age Groups | Income Levels | Geographic Locations |

|---|---|---|

| 25-45 years old | Middle to high income earners | Urban areas with high real estate demand |

| 45-65 years old | High income earners and investors | Metropolitan regions and popular real estate markets |

Risks and Benefits of Targeting No-Doc Mortgage Audience

- Risks: Higher default rates due to less stringent income verification, potential for increased exposure to fraud or misrepresentation.

- Benefits: Access to a niche market segment, increased loan volume and revenue potential, competitive advantage in the lending industry.

Risk Assessment and Underwriting Practices of No-Doc Mortgage Lenders

When it comes to no-doc mortgage lending, risk assessment and underwriting practices play a crucial role in determining the eligibility of borrowers without traditional documentation. Let’s delve into how no-doc mortgage lenders evaluate risk and make underwriting decisions.

Assessment of Borrower Risk Without Traditional Documentation

- No-doc mortgage lenders rely on alternative data sources to assess the creditworthiness of borrowers who may not have the typical financial documentation.

- These alternative data sources can include bank statements, payment history, employment history, and even social media profiles.

- By analyzing these non-traditional data points, lenders can get a more comprehensive view of a borrower’s financial situation and ability to repay the loan.

Underwriting Criteria for No-Doc Mortgages

- Lenders use a combination of factors such as credit score, loan-to-value ratio, and debt-to-income ratio to evaluate applications for no-doc mortgages.

- While traditional lenders require extensive documentation, no-doc lenders focus more on the overall financial picture and stability of the borrower.

- Approval or denial decisions are based on the lender’s assessment of the borrower’s risk level and likelihood of repayment.

Impact of Alternative Data Sources on Risk Assessment

- Alternative data sources have revolutionized risk assessment in no-doc mortgage lending by providing a more holistic view of a borrower’s financial situation.

- These sources help lenders identify patterns and trends that may not be evident from traditional documentation alone.

- By incorporating alternative data, lenders can make more informed decisions and potentially approve borrowers who would have been overlooked by traditional lenders.

Examples of Alternative Data Sources in No-Doc Mortgage Underwriting

- Bank statements showing consistent income deposits

- Rental payment history to demonstrate a track record of timely payments

- Employment verification through direct employer contact

Comparison with Traditional Mortgage Lenders

- Traditional mortgage lenders heavily rely on documented proof of income, assets, and liabilities for underwriting decisions.

- No-doc mortgage lenders, on the other hand, focus more on the overall financial health of the borrower and their ability to repay the loan.

- This difference in approach allows for greater flexibility in lending to borrowers who may not fit the traditional mold.

Role of Technology and Automation in Risk Assessment

- Technology and automation play a significant role in streamlining risk assessment and underwriting processes for no-doc mortgages.

- Automated systems can quickly analyze alternative data sources, perform risk calculations, and generate approval decisions in a fraction of the time it would take manually.

- This efficiency not only speeds up the lending process but also helps reduce human error and bias in decision-making.

Financial Stability and Viability of No-Doc Mortgage Lenders

In the realm of no-doc mortgage lending, the financial stability and viability of lenders are crucial factors that determine their long-term success and sustainability in the market. Let’s delve deeper into how these lenders navigate the economic landscape to ensure their profitability and growth.

Strategies for Ensuring Viability

No-doc mortgage lenders employ various strategies to maintain their financial stability and viability. One key approach is diversifying their loan portfolios to spread risk and minimize exposure to a single market segment. By offering a mix of loan products, these lenders can adapt to changing market conditions and reduce the impact of economic fluctuations.

Furthermore, stringent risk assessment processes are integral to the operations of no-doc mortgage lenders. By thoroughly evaluating the creditworthiness of borrowers and implementing robust underwriting standards, these lenders can mitigate the risk of defaults and losses. This proactive approach to risk management helps safeguard their financial health and reputation in the industry.

In addition, maintaining adequate capital reserves is essential for weathering economic uncertainties and unforeseen challenges. No-doc mortgage lenders prioritize building up reserves to cover potential losses and ensure liquidity in times of crisis. This financial cushion provides a buffer against external shocks and reinforces the lender’s financial position.

Impact of Economic Changes

Potential economic changes, such as fluctuations in interest rates or shifts in the housing market, can significantly impact the profitability and sustainability of no-doc mortgage lenders by 2025. Regulatory changes, increased market competition, and borrower default rates are also key factors that influence the financial health of these lenders.

For instance, a rise in interest rates could lead to a decline in mortgage demand, affecting the revenue streams of no-doc lenders. Similarly, changes in housing market trends may influence the volume and performance of their loan portfolios. By closely monitoring these economic indicators and adapting their strategies accordingly, lenders can navigate challenges and seize opportunities for growth.

Comparison with Traditional Mortgage Lenders

When comparing the financial stability and risk management practices of traditional mortgage lenders with those of no-doc mortgage lenders, distinct differences emerge in their approaches. Traditional lenders typically follow more conservative underwriting standards and rely on extensive documentation to assess borrower creditworthiness.

In contrast, no-doc mortgage lenders leverage innovative technologies and alternative data sources to streamline the lending process and cater to borrowers with non-traditional income sources. While this approach offers flexibility and accessibility to a broader range of borrowers, it also poses unique risks related to credit quality and default rates.

Competition Among No-Doc Mortgage Lenders

Competition among no-doc mortgage lenders is fierce as they strive to attract borrowers who are seeking alternative financing options without the need for extensive documentation.

Key Players in the Market

Some of the key players in the market of no-doc mortgage lending include:

- Lender A: Known for quick approval processes and competitive interest rates.

- Lender B: Specializes in catering to self-employed individuals with fluctuating income.

- Lender C: Offers unique loan products for borrowers with non-traditional credit profiles.

Competitive Landscape and Market Share

The competitive landscape in the no-doc mortgage lending market is constantly evolving, with lenders vying for a larger market share by offering innovative loan products and services. Market share is divided among various lenders based on their customer base and loan volume.

Strategies to Differentiate Themselves

To stand out from competitors, lenders employ different strategies such as:

- Providing personalized customer service to enhance the borrower experience.

- Offering niche loan products tailored to specific borrower needs.

- Implementing advanced technology for faster loan processing and approval.

Customer Experience and Satisfaction with No-Doc Mortgages

Customer feedback and reviews play a crucial role in understanding the overall experience and satisfaction levels of borrowers who opt for no-doc mortgages. Let’s delve into how customers perceive and interact with no-doc mortgage lenders.

Customer Feedback and Reviews

- Many customers appreciate the streamlined application process of no-doc mortgages, as it saves time and hassle compared to traditional mortgage applications.

- Some borrowers have expressed concerns about the higher interest rates associated with no-doc mortgages, leading to mixed reviews on the overall cost-effectiveness.

- Customers value the flexibility offered by no-doc mortgages, especially for self-employed individuals or those with non-traditional income sources.

Level of Satisfaction Among Borrowers

- Overall, satisfaction levels among borrowers who have chosen no-doc mortgages vary based on individual experiences and financial situations.

- Those who prioritize convenience and flexibility tend to be more satisfied with their decision, while others who focus on cost-saving measures may have reservations.

- Lenders can enhance satisfaction by providing clear communication, personalized guidance, and competitive rates tailored to each borrower’s needs.

Improving Customer Experience in the Future

- Implementing user-friendly digital platforms for seamless communication and document submission can enhance the customer experience significantly.

- Offering personalized loan options based on individual financial profiles and goals can help lenders better meet the diverse needs of borrowers.

- Continuously gathering feedback and making adjustments based on customer suggestions can lead to a more customer-centric approach in the future.

Economic Impacts of No-Doc Mortgage Lenders

No-doc mortgage lenders have significant economic implications as they operate in a way that differs from traditional mortgage lenders. These lenders offer loans without requiring extensive documentation from borrowers, which can lead to both positive and negative effects on the economy.

Impact on Economic Growth

No-doc mortgage lenders can contribute to economic growth by providing access to credit for individuals who may not qualify for traditional mortgages. This can stimulate housing market activity, increase homeownership rates, and boost overall consumer spending. Additionally, the streamlined application process of no-doc mortgages can expedite the home buying process, leading to quicker transactions and investments in the real estate sector.

Impact on Economic Stability

However, the rise of no-doc mortgages can also pose risks to economic stability. The reduced documentation requirements may result in higher default rates if borrowers are unable to repay their loans. This could lead to an increase in mortgage delinquencies, foreclosures, and financial instability within the housing market. Moreover, the lack of verification of borrower income and assets can create uncertainty and potential volatility in the financial system.

Potential Scenarios by 2025

By 2025, the activities of no-doc mortgage lenders could impact the economy in various ways. If the housing market experiences a boom fueled by no-doc mortgages, there may be a short-term increase in economic growth as construction, real estate transactions, and consumer spending rise. However, if these loans lead to a housing bubble that eventually bursts, it could result in a significant economic downturn, similar to the 2008 financial crisis. Policymakers, regulators, and lenders need to closely monitor the market to prevent excessive risk-taking and ensure the long-term stability of the economy.

Ethics and Transparency in No-Doc Mortgage Lending

In the realm of no-doc mortgage lending, where borrowers do not have to provide extensive documentation to verify their income or assets, ethical considerations and transparency play a crucial role in maintaining trust and integrity in the lending process.

Ethical Considerations in Offering No-Doc Mortgages

- It is essential to ensure that borrowers fully understand the terms of the loan and the potential risks involved in opting for a no-doc mortgage.

- Lenders should refrain from exploiting borrowers who may not have the financial means to sustain such loans in the long term.

- Ethical behavior involves acting in the best interest of the borrower and not engaging in deceptive practices to secure loan approvals.

Importance of Transparency in Lending Process

- Transparency is key to fostering trust between lenders and borrowers, as it allows for open communication and full disclosure of information.

- By being transparent about the terms, conditions, and potential risks associated with a no-doc mortgage, lenders can ensure that borrowers make informed decisions.

- Transparent lending practices can help prevent misunderstandings, disputes, and ultimately protect the financial stability of both parties involved.

Building Trust Through Ethical Practices

- Adhering to ethical practices and maintaining transparency can build long-term trust with customers, leading to repeat business and positive word-of-mouth referrals.

- Borrowers are more likely to feel valued and respected when lenders prioritize ethical behavior and transparency throughout the lending process.

- Trust is the foundation of a successful lender-borrower relationship, and ethical conduct is essential in nurturing that trust over time.

Regulatory Measures for Ensuring Ethical Behavior

- Regulators can implement strict guidelines and oversight to ensure that lenders comply with ethical standards when offering no-doc mortgages.

- Enforcing transparency requirements and conducting regular audits can help detect any unethical practices and prevent potential harm to borrowers.

- Regulatory bodies play a crucial role in safeguarding the interests of borrowers and maintaining the integrity of the lending industry.

Best Practices for Maintaining Transparency

- Providing clear and concise explanations of loan terms, fees, and repayment schedules can help borrowers understand the implications of taking out a no-doc mortgage.

- Offering educational resources and counseling services to borrowers can empower them to make informed decisions about their financial futures.

- Regularly updating borrowers on the status of their loan applications and being responsive to their inquiries can enhance transparency and trust in the lending process.

Impact of Ethical Behavior and Transparency on Customer Satisfaction

- In traditional mortgage lending, ethical behavior and transparency are essential for building trust and satisfaction among customers, leading to long-term relationships.

- Compared to traditional lending, ethical practices and transparency in no-doc mortgage lending can help mitigate risks and ensure that borrowers feel confident in their financial decisions.

- Customer satisfaction is closely linked to the level of trust and transparency maintained by lenders, underscoring the importance of ethical conduct in the lending industry.

Global Perspectives on No-Doc Mortgage Lenders

When looking at the global landscape of no-doc mortgage lenders, it is important to consider the varying prevalence of these lenders in different countries.

Comparison of Prevalence

Across the globe, the prevalence of no-doc mortgage lenders varies significantly. Countries like the United States have historically had a higher number of these lenders compared to nations in Europe or Asia. This can be attributed to differences in regulatory frameworks and cultural attitudes towards risk and transparency.

Regulatory and Cultural Influences

Regulations play a crucial role in shaping the adoption of no-doc mortgages worldwide. Countries with stringent lending laws and consumer protection measures are less likely to see a proliferation of no-doc mortgage lenders. Cultural differences also come into play, as some societies prioritize financial transparency and thorough documentation in all transactions.

Opportunities for International Expansion

By 2025, there may be potential opportunities for no-doc mortgage lenders to expand internationally. As technology advances and global financial markets become more interconnected, these lenders could explore new markets where there is a demand for alternative lending options. However, they would need to navigate diverse regulatory environments and adapt their practices to suit the cultural norms of each country.

Sustainability and Social Responsibility in No-Doc Mortgage Lending

When it comes to the realm of no-doc mortgage lending, sustainability and social responsibility play a crucial role in shaping the reputation and impact of lenders. In today’s world, where environmental concerns are at the forefront of many discussions, it is essential for mortgage lenders to evaluate their practices through a sustainable and socially responsible lens.

Environmental Impact of No-Doc Mortgage Lending

No-doc mortgage lending practices can have significant environmental impacts, especially if not properly managed. The use of resources, such as paper and energy, in the mortgage process can contribute to carbon emissions and waste production. Lenders need to consider ways to minimize their environmental footprint by adopting digital processes, reducing paper usage, and promoting energy-efficient operations.

Social Responsibility Initiatives

Lenders can incorporate social responsibility initiatives by supporting community development projects, promoting financial literacy programs, and offering affordable housing options. By engaging with the community and addressing social issues, lenders can build trust and credibility among borrowers and stakeholders.

Reputation Management through Social Responsibility

Social responsibility plays a key role in shaping the reputation of no-doc mortgage lenders. Lenders that demonstrate a commitment to ethical practices, transparency, and social causes are more likely to attract customers and investors. By prioritizing social responsibility, lenders can differentiate themselves in a competitive market and build long-lasting relationships with clients.

Future Outlook and Emerging Trends in No-Doc Mortgage Lending

The future of no-doc mortgage lending beyond 2025 is likely to see significant evolution as the industry adapts to changing technologies, customer preferences, and regulatory environments. Emerging trends are expected to disrupt traditional practices and present both challenges and opportunities for lenders.

Impact of Blockchain Technology

Blockchain technology has the potential to revolutionize the no-doc mortgage lending process by enhancing security, transparency, and efficiency. Smart contracts on the blockchain can automate verification processes, reduce fraud, and streamline transactions, leading to faster approval times and lower costs for both lenders and borrowers.

Rise of Biometric Authentication

Biometric authentication methods, such as facial recognition and fingerprint scanning, are becoming increasingly popular for identity verification in financial transactions. No-doc mortgage lenders could leverage these technologies to enhance security and simplify the application process for borrowers, reducing the risk of identity theft and fraud.

Shift Towards AI-Powered Underwriting

Artificial intelligence (AI) is expected to play a crucial role in streamlining the no-doc mortgage application process. AI algorithms can analyze large volumes of data to assess creditworthiness, detect patterns of risk, and make accurate lending decisions in real-time. This can improve efficiency, reduce manual errors, and provide more personalized loan options for borrowers.

Regulatory Changes and Compliance

Changes in government regulations, especially in response to economic fluctuations or financial crises, can significantly impact the future of no-doc mortgage lending. Lenders will need to stay updated on regulatory requirements, ensure compliance with consumer protection laws, and adapt their practices to meet evolving standards for transparency and accountability.

Integration of Machine Learning in Customer Service

Machine learning technologies can enhance customer service in the no-doc mortgage lending industry by analyzing customer preferences, predicting behavior, and offering personalized recommendations. Automated chatbots and virtual assistants can provide round-the-clock support, answer queries, and guide borrowers through the application process, improving overall customer experience and satisfaction.

Last Word

In conclusion, the future of no-doc mortgage lenders holds promise for both borrowers and lenders alike, ushering in a new era of convenience and efficiency in the mortgage lending industry. As technology continues to evolve and regulations adapt to the changing landscape, no-doc mortgages are poised to make a lasting impact well into 2025 and beyond.