Low interest online business loans 2025 pave the way for businesses to secure affordable funding, propelling growth and expansion in the digital age. As technology continues to shape the lending landscape, accessing capital with favorable terms becomes increasingly crucial for entrepreneurial success.

In the coming years, businesses will witness a shift towards online platforms offering competitive interest rates, streamlined application processes, and innovative loan assessment methods. This evolution marks a significant departure from traditional bank loans, signaling a new era of financial accessibility and flexibility for aspiring entrepreneurs and established enterprises alike.

Overview of Low Interest Online Business Loans 2025

In 2025, low interest online business loans have become a popular financing option for businesses looking to secure funding with favorable terms. These loans offer competitive interest rates that are often lower than those provided by traditional banks, making them an attractive choice for entrepreneurs and small business owners.

Significance of Low Interest Online Business Loans

- Low interest online business loans play a crucial role in supporting the growth and expansion of businesses by providing access to affordable capital.

- These loans enable businesses to invest in new projects, purchase equipment, hire additional staff, or cover operational expenses without incurring high financing costs.

Benefits of Opting for Low Interest Online Business Loans

- Lower interest rates translate to reduced overall borrowing costs, allowing businesses to save money in the long run.

- Online platforms or lenders specializing in low interest business loans offer streamlined application processes and quick approval times, providing convenience and efficiency to borrowers.

Examples of Online Platforms or Lenders

- Popular online lenders such as LendingClub, Funding Circle, and Kabbage are known for offering low interest business loans to eligible applicants.

- Online marketplaces like Fundera and Lendio also connect businesses with multiple lenders, increasing the chances of finding competitive loan options.

Application Process Comparison

Applying for traditional bank loans often involves extensive paperwork, long processing times, and stringent eligibility criteria. In contrast, online business loans with low interest rates typically have simpler applications, faster approvals, and more flexible qualifications.

Impact of AI and Machine Learning

- Artificial intelligence and machine learning algorithms are increasingly used by online lenders to assess creditworthiness, analyze financial data, and determine loan eligibility.

- These technologies can expedite the approval process and provide more accurate risk assessments, benefiting both lenders and borrowers.

Repayment Terms and Differences

Low interest online business loans usually come with favorable repayment terms, including longer repayment periods, lower monthly installments, and fixed interest rates. In contrast, high-interest loans may have shorter terms, higher payments, and variable interest rates.

Improving Creditworthiness for Qualification

- Businesses can enhance their creditworthiness by maintaining a positive payment history, reducing outstanding debts, monitoring credit reports, and establishing strong business financials.

- Regularly reviewing and improving credit scores can increase the likelihood of qualifying for low interest online business loans in the future.

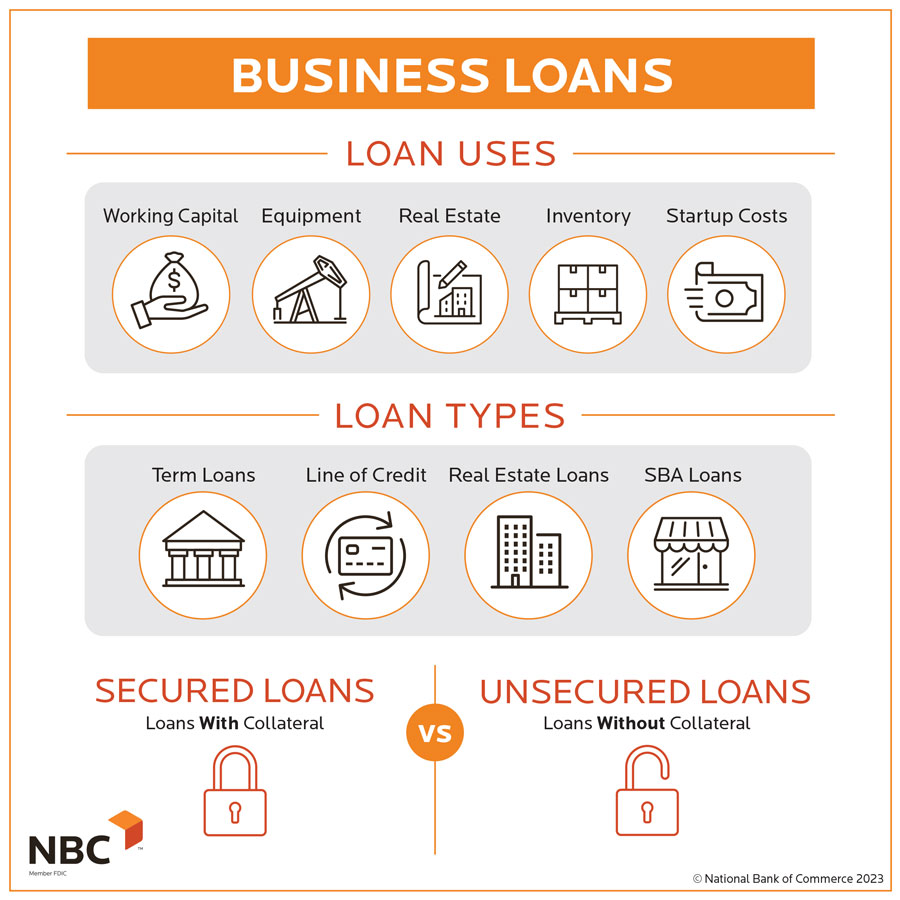

Role of Collateral in Securing Loans

While some online lenders may require collateral to secure low interest business loans, others offer unsecured options based on creditworthiness and financial stability. Collateral requirements vary among lenders, with some accepting assets like real estate, equipment, or inventory.

Current Trends in Online Lending for Businesses

Online lending for businesses has been rapidly evolving in recent years, with several trends shaping the landscape of business loans. As technology continues to advance, traditional business loan processes are being compared to modern online lending platforms, offering businesses more accessible and efficient ways to secure funding.

Increased Accessibility and Convenience

- Online lending platforms have made it easier for businesses to apply for loans without the need for extensive paperwork or in-person meetings.

- Business owners can now submit loan applications, upload necessary documents, and receive funding approval within a matter of days, streamlining the entire loan process.

- With 24/7 accessibility, online lending platforms offer convenience for businesses to secure funding at any time, without being restricted by traditional banking hours.

Personalized Loan Options

- Online lenders utilize technology to analyze data and provide personalized loan options tailored to the specific needs and financial situation of each business.

- Business owners can access a variety of loan products, such as term loans, lines of credit, and invoice financing, allowing them to choose the best fit for their unique circumstances.

- Personalized loan options help businesses secure funding that aligns with their goals and cash flow requirements, improving the overall borrowing experience.

Integration of Artificial Intelligence and Machine Learning

- Online lending platforms are increasingly incorporating artificial intelligence and machine learning algorithms to assess creditworthiness and automate the loan underwriting process.

- By utilizing advanced technologies, lenders can make faster and more accurate lending decisions, reducing the time it takes for businesses to receive funding.

- AI and machine learning also enable lenders to better predict credit risk and offer competitive interest rates to businesses, creating a more efficient and transparent lending environment.

Impact of Low Interest Rates on Business Growth

Low interest rates can have a significant impact on the growth of businesses by reducing the cost of borrowing money. This means that businesses can access capital at a lower cost, allowing them to invest in expansion, research and development, and other growth initiatives. When businesses can borrow money at lower interest rates, they are more likely to take on new projects and hire more employees, ultimately driving growth and creating economic opportunities.

Benefits of Low Interest Rates for Businesses

- Lower borrowing costs: Businesses can borrow money at a lower cost, making it more affordable to invest in growth.

- Increased access to capital: Lower interest rates make it easier for businesses to access the funding they need to expand.

- Boost in consumer spending: Lower interest rates can lead to increased consumer spending, benefiting businesses across various sectors.

Examples of Businesses Benefiting from Low Interest Loans

- A tech startup that used a low-interest loan to develop a new product line, leading to increased sales and market share.

- A small business that expanded its operations after securing a low-interest loan, creating jobs and driving economic growth in the community.

- A manufacturing company that upgraded its equipment with a low-interest loan, improving efficiency and competitiveness in the market.

Strategies for Leveraging Low Interest Rates for Business Expansion

- Refinance existing debt at a lower interest rate to reduce overall borrowing costs.

- Invest in technology and innovation to stay competitive and drive growth in the long term.

- Create a solid business plan outlining how the borrowed funds will be used to achieve growth and profitability.

Factors Influencing Interest Rates for Online Business Loans

When it comes to online business loans, the interest rates are influenced by various factors that can determine how much a business will end up paying in the long run. Understanding these factors is crucial for businesses looking to secure the best possible rates for their financial needs.

Lender’s Risk Assessment

One key factor that influences interest rates for online business loans is the lender’s risk assessment. Lenders will evaluate the creditworthiness of a business, considering factors such as credit score, financial statements, and business history. Businesses with a strong credit profile are more likely to qualify for lower interest rates.

Loan Term and Amount

The loan term and amount requested can also impact the interest rate offered by online lenders. Generally, longer loan terms and larger loan amounts may come with higher interest rates to compensate for the extended repayment period and increased risk for the lender.

Market Conditions

Market conditions play a significant role in determining interest rates for online business loans. Factors such as the overall economic climate, inflation rates, and the Federal Reserve’s monetary policy can influence interest rates. Businesses should stay informed about market trends to anticipate potential changes in interest rates.

Collateral and Guarantees

Providing collateral or personal guarantees can affect the interest rates for online business loans. Lenders may offer lower rates to businesses that offer valuable assets as collateral, as it reduces the lender’s risk in case of default. Businesses willing to secure their loans with collateral may benefit from more favorable interest rates.

Industry and Business Performance

The industry in which a business operates and its overall performance can also impact the interest rates for online loans. Lenders may consider the stability and growth potential of the business when determining the interest rate. Businesses with a strong track record and positive growth outlook may qualify for lower rates.

Emerging Technologies in Online Business Lending

In today’s digital era, emerging technologies are reshaping the landscape of online business lending, offering innovative solutions to streamline processes and enhance efficiency. Let’s delve into the role of these technologies in revolutionizing the way loans are assessed, approved, and disbursed in the online lending industry.

AI and Machine Learning in Loan Application Assessment

Artificial Intelligence (AI) and machine learning algorithms are increasingly being utilized by online lenders to assess loan applications more accurately and efficiently. These technologies can analyze vast amounts of data to evaluate creditworthiness, predict default risks, and personalize loan terms based on individual business needs.

- AI algorithms can identify patterns and trends in borrower behavior, financial transactions, and market conditions to make data-driven lending decisions.

- Machine learning models can assess credit risk in real-time, enabling lenders to offer faster loan approvals and disbursements.

- These technologies enhance the overall customer experience by providing personalized loan offers and tailored financial solutions.

Blockchain Technology for Enhanced Security

Blockchain technology plays a crucial role in enhancing the security and transparency of online loans. By creating immutable and decentralized ledgers, blockchain ensures that loan transactions are secure, tamper-proof, and verifiable, reducing the risk of fraud and data breaches.

- Smart contracts powered by blockchain automate loan agreements, payment schedules, and collateral management, reducing the need for intermediaries and minimizing operational costs.

- Blockchain enables seamless verification of borrower identity, credit history, and financial records, streamlining the loan approval process and reducing documentation errors.

- The decentralized nature of blockchain ensures that sensitive borrower information is stored securely and can only be accessed by authorized parties, enhancing data privacy and protection.

AI Algorithms for Credit Risk Assessment

AI algorithms commonly used in credit risk assessment include logistic regression, decision trees, random forests, and neural networks. These algorithms analyze historical loan data, borrower profiles, and economic indicators to predict creditworthiness and default probabilities accurately.

- Supervised machine learning techniques train models on labeled data to classify borrowers into different risk categories and assign credit scores based on predefined criteria.

- Unsupervised machine learning algorithms identify hidden patterns in loan data and segment borrowers into risk groups without predefined labels, enabling lenders to assess credit risk more holistically.

- Advanced AI models combine supervised and unsupervised learning approaches to improve the accuracy and reliability of credit risk assessments, reducing loan default rates and maximizing lender profitability.

Challenges and Ethical Considerations of AI in Loan Decision-Making

While AI offers numerous benefits in online lending, it also presents challenges and ethical considerations that must be addressed. Potential issues include algorithmic bias, lack of transparency in decision-making, and data privacy concerns that can impact borrower trust and regulatory compliance.

- Lenders must ensure that AI algorithms are free from bias and discrimination, as biased models can lead to unfair lending practices and negatively impact certain borrower groups.

- Transparency in AI decision-making is essential to explain how loan decisions are made, the factors considered, and the rationale behind credit assessments to build trust with borrowers and regulatory authorities.

- Data privacy regulations, such as GDPR, require lenders to secure borrower information, obtain consent for data usage, and provide transparency on how personal data is collected, processed, and stored to protect consumer rights and prevent misuse of sensitive data.

Strategies for Securing Low Interest Online Business Loans

Securing low interest online business loans can be crucial for the financial health and growth of your business. Here are some key strategies to help you secure the best loan terms possible.

Improving Credit Scores for Better Loan Rates

One of the first steps to securing low interest online business loans is to improve your credit score. Lenders often use credit scores to assess the risk of lending to a business, so maintaining a good credit score can help you access better loan rates.

Importance of a Strong Business Plan

A strong business plan is essential when applying for online business loans. Lenders want to see that you have a clear vision for your business and a solid plan for how you will use the loan funds. A well-thought-out business plan can help you secure more favorable loan terms.

Key Factors Considered by Lenders

- Revenue and cash flow of the business

- Business credit history

- Collateral offered (if applicable)

- Debt-to-income ratio

Required Documents for Loan Applications

When applying for online business loans, you may need to provide documents such as:

- Business tax returns

- Profit and loss statements

- Balance sheets

- Bank statements

Comparing Online Lenders

It’s important to compare different online lenders to find the best loan terms for your business. Consider factors such as interest rates, loan terms, and repayment options before making a decision.

Common Pitfalls to Avoid

- Applying for loans you can’t afford to repay

- Not checking your credit score before applying

- Ignoring the terms and conditions of the loan

Future Outlook for Low Interest Online Business Loans

The future of low interest online business loans beyond 2025 looks promising as technology continues to advance and streamline the lending process. However, there are potential challenges that may arise in the online lending industry, along with opportunities for growth and innovation.

Potential Challenges in Online Lending

- Rising competition among online lenders leading to lower interest rates, impacting profitability.

- Increased regulatory scrutiny and compliance requirements, adding complexity to loan approval processes.

- Cybersecurity threats and data breaches posing risks to sensitive financial information of businesses and lenders.

Opportunities for Growth and Innovation

- Integration of artificial intelligence and machine learning to enhance credit risk assessment and decision-making processes.

- Expansion of peer-to-peer lending platforms, providing alternative financing options for businesses.

- Development of blockchain technology for secure and transparent loan transactions, reducing fraud and improving trust.

Comparison of Different Types of Online Business Loans

When it comes to obtaining funding for your business, there are several types of online business loans available in the market. Each type has its own unique features and benefits, tailored to suit different business needs and scenarios.

Term Loans

Term loans are a common type of business loan where a lump sum is provided upfront, which is then repaid over a set term with a fixed or variable interest rate.

- Provides a large sum of money upfront for specific business needs like expansion or equipment purchases.

- Fixed monthly payments make budgeting easier for businesses.

- Best suited for long-term investments or projects with a clear repayment plan.

Lines of Credit

A business line of credit allows you to borrow funds up to a certain limit, similar to a credit card, where you can draw funds as needed and only pay interest on the amount borrowed.

- Flexible borrowing option for managing cash flow fluctuations or unexpected expenses.

- Interest is only charged on the amount borrowed, not the entire credit limit.

- Best suited for short-term financing needs or covering operational expenses.

SBA Loans

Small Business Administration (SBA) loans are government-backed loans designed to support small businesses by providing access to funding with favorable terms and lower interest rates.

- Offer lower interest rates and longer repayment terms compared to traditional loans.

- Strict eligibility requirements and longer approval process due to government involvement.

- Best suited for businesses looking for affordable financing options with flexible terms.

Case Studies

In this section, we will explore case studies of successful businesses that have utilized low interest online loans to fuel their growth and expansion, providing valuable insights for other businesses looking to secure online loans.

Case Study 1: E-commerce Startup X

- E-commerce Startup X secured a low interest online loan to invest in digital marketing campaigns and expand their product line.

- By utilizing the borrowed funds strategically, E-commerce Startup X was able to increase their customer base and revenue significantly.

- Key takeaway: Investing in marketing and product expansion can lead to substantial growth and success for businesses in the e-commerce sector.

Case Study 2: Tech Company Y

- Tech Company Y used a low interest online loan to develop a new software product and hire additional developers.

- With the help of the borrowed funds, Tech Company Y was able to launch the new product successfully and scale their operations.

- Key takeaway: Innovation and talent acquisition are crucial for tech companies looking to leverage online loans for growth.

Case Study 3: Service Provider Z

- Service Provider Z opted for a low interest online loan to upgrade their equipment and improve service quality.

- As a result of the equipment upgrade, Service Provider Z saw an increase in customer satisfaction and repeat business.

- Key takeaway: Investing in infrastructure and customer experience can yield long-term benefits for service-oriented businesses.

Regulatory Environment for Online Business Lending

The regulatory environment plays a crucial role in shaping the landscape of online business lending, influencing the availability of low-interest loans and ensuring a fair marketplace for both lenders and borrowers.

Specific Laws and Agencies

In the United States, online business lending is subject to various laws and regulations, including the Truth in Lending Act (TILA), the Equal Credit Opportunity Act (ECOA), and the Dodd-Frank Wall Street Reform and Consumer Protection Act. Regulatory oversight is primarily carried out by the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC).

Impact of Government Policies

Government policies and regulations can have a significant impact on the availability of low-interest loans in online business lending. Striking a balance between consumer protection and fostering innovation is key to ensuring a healthy lending environment. While regulations can provide safeguards against predatory practices, overly restrictive policies may hinder access to credit for small businesses.

Pros and Cons of Existing Regulations

Existing regulations in online lending have pros and cons. For example, the introduction of standardized disclosure requirements under TILA has improved transparency for borrowers. However, stringent underwriting standards mandated by Dodd-Frank may limit the flexibility of online lenders, especially in serving underserved markets.

Comparison of Regulatory Environments

The regulatory environment for online business lending varies across countries. For instance, the United Kingdom has implemented the Financial Conduct Authority (FCA) regulations to ensure fair lending practices. In contrast, regulatory frameworks in emerging markets may be less developed, leading to potential risks for both lenders and borrowers.

Major Requirements for Online Lenders

| Requirement | Description |

|---|---|

| Licensing | Online lenders must obtain the necessary licenses to operate legally. |

| Disclosure | Lenders are required to provide clear and accurate information about loan terms and costs to borrowers. |

| Privacy Protection | Lenders must adhere to strict data protection regulations to safeguard borrower information. |

| Fair Lending Practices | Lenders should not discriminate against borrowers based on factors like race or gender. |

Impact of Global Economic Conditions on Online Business Lending

Global economic conditions play a significant role in shaping the landscape of online business lending. Various factors such as inflation, interest rates, and geopolitical events can have a direct impact on the availability and terms of online business loans.

Economic Factors Influencing Online Business Lending

- During a recession, online lenders may tighten their lending criteria, leading to higher interest rates and stricter approval processes.

- In times of economic boom, online lenders might be more lenient with lending, offering lower interest rates to attract businesses looking to expand.

- Geopolitical events like trade wars or global conflicts can create uncertainty in financial markets, leading to fluctuations in online loan rates.

Credit Risk and Global Economic Factors

Credit risk, the likelihood of a borrower defaulting on a loan, is heavily influenced by global economic conditions. For example, businesses operating in industries vulnerable to economic downturns may face higher credit risk, impacting their ability to secure favorable loan terms.

Adapting to Economic Uncertainties

- Online lenders can implement risk management strategies to mitigate the impact of changing economic conditions, such as diversifying their loan portfolios or stress-testing their lending practices.

- Businesses seeking online loans should stay informed about global economic trends and adapt their financial strategies accordingly to navigate uncertainties effectively.

Importance of Financial Literacy for Businesses Applying for Online Loans

Financial literacy is crucial for businesses seeking online loans as it enables them to make informed decisions regarding their financial health and borrowing needs. With a solid understanding of financial concepts, business owners can navigate the loan application process more effectively and secure favorable terms. Here we delve into the significance of financial literacy in the context of applying for online business loans.

Resources and Tools for Improving Financial Literacy

- Utilize online resources such as webinars, articles, and educational videos to enhance financial knowledge.

- Consider attending workshops or seminars focused on financial literacy for business owners.

- Explore reputable online courses that cover essential financial topics relevant to loan applications.

Analyzing Financial Statements for Business Health Assessment

- Learn to interpret financial statements such as balance sheets, income statements, and cash flow statements.

- Understand key financial ratios like debt-to-equity ratio, current ratio, and gross profit margin to assess business performance.

- Use financial analysis tools to evaluate profitability, liquidity, and solvency before applying for online loans.

Interactive Exercises and Quizzes for Reinforcing Financial Concepts

- Engage in interactive exercises or quizzes that test your understanding of financial terms and calculations.

- Practice analyzing financial data and interpreting results to strengthen financial literacy skills.

- Seek feedback from financial experts or mentors to improve your financial knowledge and decision-making abilities.

Case Studies Demonstrating the Impact of Financial Literacy on Loan Applications

- Explore real-world examples where businesses with strong financial literacy secured better loan terms and expanded their operations.

- Analyze how financial acumen helped businesses overcome challenges and capitalize on opportunities through strategic borrowing.

- Learn from successful loan applicants who attributed their achievements to a deep understanding of financial principles and practices.

Recommendations for Reputable Financial Literacy Courses

- Consider enrolling in courses offered by financial institutions, universities, or industry associations specializing in business finance.

- Look for workshops tailored to small business owners that cover fundamental financial concepts essential for loan applications.

- Seek recommendations from peers or advisors on high-quality financial literacy programs with proven track records of success.

Sustainable Practices in Online Business Lending

When it comes to sustainable practices in online business lending, it involves incorporating environmental and social considerations into the loan decision-making process. Lenders evaluate not only the financial health of a company but also its impact on the environment and society.

Criteria for Evaluating Environmental and Social Factors

- Lenders look at a company’s sustainability initiatives, such as energy efficiency measures, waste reduction programs, and social responsibility efforts.

- They also consider the industry in which the business operates and its potential environmental and social impact.

- Companies that demonstrate a commitment to sustainable practices are more likely to receive favorable loan terms.

Impact of Sustainable Lending Practices

- By adopting sustainable lending practices, companies can improve their reputation, attract socially conscious investors, and reduce operational costs through energy savings.

- Investing in environmentally friendly technologies can lead to long-term cost savings and increased competitiveness in the market.

Comparison between Traditional and Sustainable Lending Practices

| Traditional Lending Practices | Sustainable Lending Practices |

|---|---|

| Focus mainly on financial metrics | Consider environmental and social impact |

| Short-term profit-driven decisions | Long-term sustainability goals |

| May overlook environmental risks | Prioritize companies with sustainable practices |

Role of Technology in Sustainable Lending

- Technology plays a crucial role in facilitating sustainable lending practices by providing data analytics tools to assess environmental and social performance.

- Online platforms can offer green financing options and connect socially responsible investors with businesses that align with their values.

The Role of Alternative Lenders in Providing Low Interest Online Business Loans

Alternative lenders play a significant role in the financial landscape by offering low-interest online business loans to small and medium-sized enterprises. These non-traditional lending sources provide businesses with access to capital that may not be available through traditional banks.

Comparison of Traditional Banks and Alternative Lenders

- Traditional banks often have strict lending requirements and lengthy approval processes, making it challenging for small businesses to secure loans. In contrast, alternative lenders typically have more flexible criteria and faster approval times, making them a more accessible option for many businesses.

- While traditional banks may offer lower interest rates for businesses with excellent credit scores, alternative lenders cater to a broader range of credit profiles, including businesses with less-than-perfect credit histories.

Advantages and Disadvantages of Alternative Lenders

- Advantages:

- Quick approval process: Alternative lenders can provide funding in a matter of days, compared to the weeks or months it may take with traditional banks.

- Flexibility in loan terms: Alternative lenders offer a variety of loan products tailored to meet the specific needs of different businesses.

- Disadvantages:

- Higher interest rates: Due to the higher risk associated with alternative lending, interest rates may be higher than those offered by traditional banks.

- Less regulation: Alternative lenders are not subject to the same regulatory oversight as traditional banks, which may lead to less protection for borrowers.

Conclusion

In conclusion, the future of low interest online business loans in 2025 holds immense promise for businesses seeking financial support. With advancements in technology, a growing array of lending options, and a focus on affordability, the landscape is primed for innovation and growth. As businesses navigate the dynamic digital economy, leveraging these loans effectively can be a strategic advantage in achieving sustainable success and expansion.