Kicking off with Loan Pre-Approval vs. Final Approval: What’s the Difference?, this opening paragraph is designed to captivate and engage the readers, setting the tone formal and friendly language style that unfolds with each word.

When it comes to navigating the complex world of loan approvals, understanding the disparity between pre-approval and final approval is crucial for a successful borrowing journey.

Loan Pre-Approval

When it comes to the home buying process, obtaining a loan pre-approval is a crucial step that can help streamline the process and provide you with a clear picture of your budget and purchasing power.

What a Loan Pre-Approval Involves

- A loan pre-approval involves a lender reviewing your financial information, such as income, credit score, and debt-to-income ratio, to determine the maximum loan amount you qualify for.

- It is not a guarantee of a loan but rather an estimate based on the information provided.

Benefits of Obtaining a Loan Pre-Approval

- Helps you understand your budget and narrow down your home search to properties within your price range.

- Gives you a competitive edge in a competitive real estate market as sellers prefer buyers with a pre-approval.

- Speeds up the loan approval process once you find a property you want to purchase.

Comparison to Final Approval Process

- A loan pre-approval is based on preliminary information provided by the borrower, while a final approval involves a more in-depth review of the borrower’s financial history and the property being purchased.

- Final approval requires a property appraisal, title search, and additional documentation, whereas pre-approval is more focused on the borrower’s financial standing.

Examples of Documents Required for a Loan Pre-Approval

- Proof of income (pay stubs, W-2s, tax returns)

- Proof of assets (bank statements, investment accounts)

- Identification (driver’s license, social security card)

- Information on debts (credit card statements, loan statements)

Final Approval

Final approval in the loan process is a crucial step that occurs after pre-approval and involves a thorough evaluation of the borrower’s financial situation and the property being financed. It signifies that the lender has reviewed all necessary documentation, conducted a detailed assessment, and is ready to provide the loan.

Significance of Final Approval

Final approval is significant as it represents the lender’s commitment to providing the loan. It gives borrowers the confidence to move forward with their home purchase or refinance, knowing that they have met all the requirements set by the lender.

Factors Influencing Final Approval Decisions

- Income and Employment History

- Credit Score and Credit History

- Debt-to-Income Ratio

- Appraised Value of the Property

- Down Payment Amount

Timeline for Final Approval after Pre-Approval

After pre-approval, the final approval process typically takes anywhere from a few days to a few weeks, depending on various factors such as the complexity of the loan application, the responsiveness of the borrower in providing additional documentation, and the lender’s workload.

Conditions for Final Approval

- Verification of Income and Assets

- Home Appraisal

- Clear Title Search

- Satisfactory Home Inspection

- Proof of Homeowners Insurance

Key Differences

In the loan approval process, there are significant variations between pre-approval and final approval that borrowers should be aware of to make informed decisions.

Terms and Conditions

- Pre-Approval: During the pre-approval stage, lenders provide an initial assessment based on the borrower’s financial information. The terms and conditions offered at this point are not final and are subject to change based on further verification.

- Final Approval: In contrast, final approval involves a detailed review of the borrower’s financial history, credit report, and property appraisal. The terms and conditions provided at this stage are more concrete and typically do not change unless there are significant discrepancies.

Level of Commitment

- Pre-Approval: Lenders offer pre-approvals with the understanding that they are not a guarantee of funding. The level of commitment from the lender in pre-approval is lower, as it is based on initial information provided by the borrower.

- Final Approval: Final approval signifies a higher level of commitment from the lender, as it involves a comprehensive assessment of the borrower’s financial situation and the property being financed. Once final approval is granted, the lender is more committed to providing the loan.

House Hunting Process

- Pre-Approval: Having a pre-approval in hand can give borrowers a competitive edge in the house hunting process, as it demonstrates to sellers that they are serious buyers with potential financing. However, it does not guarantee that the loan will be approved.

- Final Approval: Final approval is the last step before the loan is funded, and it provides borrowers with the confidence to proceed with closing the deal on a property. Once final approval is obtained, borrowers can be more certain about the success of their loan application.

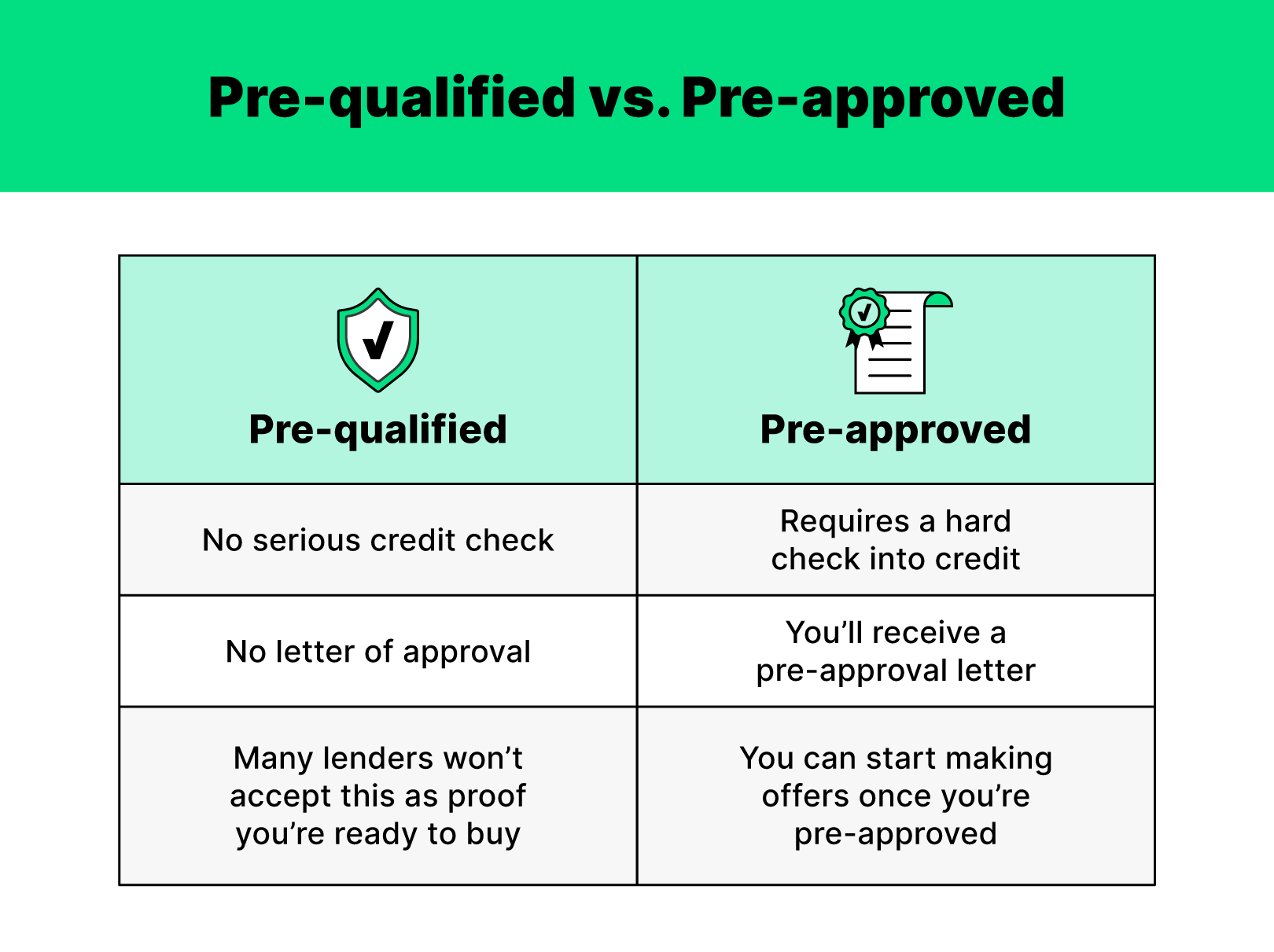

Credit Check

When applying for a loan, one crucial aspect that lenders consider is the borrower’s credit history. A credit check is typically conducted during both the pre-approval and final approval stages to assess the borrower’s creditworthiness.

Role of Credit Checks in Loan Pre-Approval

In the loan pre-approval stage, lenders will perform a basic credit check to get an initial idea of the borrower’s credit score and history. This helps them determine whether the borrower meets the minimum requirements for a loan.

Impact of Credit Scores on Pre-Approval and Final Approval

Credit scores play a significant role in both the pre-approval and final approval processes. A higher credit score generally indicates a lower credit risk for the lender, making it more likely for the borrower to be approved for a loan. Borrowers with higher credit scores are also likely to qualify for lower interest rates and better loan terms.

Ways to Improve Credit Scores for Better Chances of Approval

To improve credit scores and increase the chances of loan approval, borrowers can take several steps such as paying bills on time, reducing debt, and monitoring their credit report for errors. By maintaining a good credit history, borrowers can enhance their credit scores over time.

Examples of Credit Score Ranges for Different Approval Stages

– Excellent Credit: 800-850

– Good Credit: 670-799

– Fair Credit: 580-669

– Poor Credit: Below 580

Borrowers with excellent or good credit scores are more likely to receive loan pre-approval and final approval compared to those with fair or poor credit scores.

Documentation

When it comes to the loan approval process, documentation plays a crucial role in determining whether you qualify for a loan or not. Here, we will delve into the specific documentation required for both pre-approval and final approval, as well as tips for organizing and preparing necessary documents.

Loan Pre-Approval Documentation

- A completed loan application form providing personal, employment, and financial information.

- Proof of income such as pay stubs, W-2 forms, or tax returns from the past two years.

- Bank statements to verify your assets and down payment funds.

- Credit report authorization to allow the lender to pull your credit history.

Final Approval Documentation

- Updated pay stubs and employment verification to ensure your income is consistent.

- Proof of additional assets or financial changes that may have occurred since pre-approval.

- A current credit report to confirm that your credit score has not significantly changed.

- Signed documentation related to the specific loan terms and conditions.

Income Verification Differences

- During pre-approval, income verification is based on the documents provided at the time of application.

- For final approval, lenders may require updated pay stubs or employment verification to ensure your income remains stable.

- Any significant changes in income or employment status can impact the final approval decision.

Tips for Document Organization

- Create a checklist of required documents for both pre-approval and final approval to stay organized.

- Keep all financial documents in one place and make copies to provide to the lender.

- Respond promptly to any requests for additional documentation to avoid delays in the approval process.

- Double-check all documents for accuracy and completeness before submitting them to the lender.

Interest Rates

Interest rates play a crucial role in determining the overall cost of a loan. Whether you are in the pre-approval stage or final approval stage, understanding how interest rates are calculated and how they can impact your loan amount is essential.

Interest Rates in Pre-Approval vs. Final Approval

In the pre-approval stage, lenders typically provide an estimated interest rate based on the information you provide. This rate is not set in stone and may change once you reach the final approval stage. During final approval, lenders will conduct a more thorough assessment of your financial situation, credit history, and other factors to determine the final interest rate for your loan.

- Pre-Approval: In this stage, interest rates are generally based on general information and may be subject to change.

- Final Approval: Interest rates are finalized based on a detailed assessment of your financial profile and creditworthiness.

Impact of Interest Rate Fluctuations

Changes in interest rates between pre-approval and final approval can have a significant impact on the loan amount you are approved for. For example, a slight increase in the interest rate can result in a higher monthly payment or a reduction in the total loan amount you qualify for. It is essential to keep this in mind when considering the affordability of the loan.

Even a small change in the interest rate can lead to a substantial difference in the total amount you pay over the life of the loan.

Examples of Interest Rate Impact

| Interest Rate | Loan Amount | Monthly Payment |

|---|---|---|

| 3.5% | $200,000 | $900 |

| 4% | $200,000 | $955 |

| 4.5% | $200,000 | $1,013 |

In this example, a 0.5% increase in the interest rate results in a higher monthly payment, making the loan less affordable over time.

Property Appraisal

Property appraisals play a crucial role in the mortgage approval process, providing an independent assessment of the property’s value to ensure it meets the lender’s criteria.

Timing of Property Appraisals

Property appraisals are typically conducted after the initial pre-approval stage, once the borrower has made an offer on a specific property. The final approval decision is often contingent upon a satisfactory appraisal.

- Property appraisals for pre-approval: In some cases, a preliminary appraisal may be done during the pre-approval process to give the borrower an idea of the property’s value and potential loan amount.

- Property appraisals for final approval: A comprehensive property appraisal is conducted during the final approval stage to confirm the property’s value and determine the loan amount.

Impact of Appraisal Values

The appraisal value of the property can significantly impact the final approval decision. Lenders use this value to determine the maximum loan amount they are willing to provide based on the property’s worth.

-

Low appraisal value: If the appraised value is lower than the purchase price, the lender may require the borrower to make up the difference in cash, renegotiate the price, or decline the loan application.

-

High appraisal value: A higher-than-expected appraisal value can benefit the borrower by potentially lowering the required down payment or improving the loan terms.

Factors Considered by Appraisers

Appraisers take various factors into account when determining a property’s value, including the property’s size, condition, location, comparable sales in the area, and market trends.

- Size and layout of the property

- Condition of the property (e.g., age, maintenance, renovations)

- Location and neighborhood characteristics

- Comparable sales data in the area

- Market trends and economic factors

Conditions

When it comes to loan pre-approvals, certain conditions may be attached that need to be met before final approval can be granted. These conditions are crucial in determining the borrower’s eligibility and ensuring that the loan can be successfully processed.

Common Conditions for Loan Pre-Approvals

- Verification of income and employment

- Documentation of assets and liabilities

- Proof of down payment

- Additional credit checks

Meeting Conditions for Final Approval

Meeting the conditions set during the pre-approval stage is essential for obtaining final approval. Lenders use this information to assess the borrower’s financial stability and creditworthiness, which are crucial factors in the approval process.

Process of Satisfying Conditions

Once the conditions are identified, borrowers must provide the necessary documentation or information to satisfy these requirements. This may involve submitting pay stubs, bank statements, or additional forms requested by the lender.

Examples of Conditions Delaying Final Approval

- Unresolved credit issues

- Insufficient income verification

- Inaccurate or incomplete documentation

- Changes in financial status during the approval process

Communication

Effective communication with lenders plays a crucial role in the loan approval process. It is essential to maintain clear and open lines of communication to ensure a smooth and efficient approval process from pre-approval to final approval.

Importance of Clear Communication

Clear communication with lenders is vital as it helps in providing all necessary information accurately and promptly. Misunderstandings or lack of communication can lead to delays or even denials in the approval process. By clearly articulating your financial situation, goals, and any changes that may occur during the process, you can help the lender make informed decisions.

- Respond promptly to any requests for additional information or documentation from the lender.

- Be transparent about any changes in your financial situation or credit profile.

- Ask questions if there is anything you do not understand to avoid any confusion.

Impact on Approval Speed

Timely communication can significantly impact the speed of both pre-approval and final approval. By promptly responding to lender requests and providing all necessary documentation, you can expedite the approval process. Delayed responses or incomplete information can cause unnecessary delays and potentially jeopardize your approval.

- Regularly check your email and phone messages for any updates or requests from the lender.

- Follow up with the lender to ensure they have received all required documents and information.

- Stay proactive and engaged throughout the approval process to keep things moving smoothly.

Significance of Timely Responses

Timely responses to lender requests are crucial for maintaining the momentum of the approval process. Delays in providing information or documentation can lead to missed deadlines and ultimately impact the final approval decision. By being prompt and responsive, you demonstrate your commitment and reliability to the lender.

- Set reminders or alerts to ensure you respond promptly to any lender inquiries.

- Organize your financial documents in advance to expedite the process when requested.

- Communicate any potential delays or issues proactively to avoid any last-minute complications.

Rejection

When applying for a loan, there is always a possibility of rejection, whether it is during the pre-approval stage or the final approval stage. Understanding the reasons for rejection and knowing how to proceed if it happens is crucial for borrowers.

Loan Application Rejection During Pre-Approval

- Insufficient income: If your income is not enough to cover the monthly payments, the lender may reject your application during pre-approval.

- Poor credit history: A low credit score or a history of missed payments can lead to rejection at this stage.

- Unstable employment: Lenders look for stable employment history as it indicates a steady income to repay the loan.

Common Reasons for Rejection at Final Approval

- Change in financial circumstances: If your financial situation changes between pre-approval and final approval, such as loss of job or increase in debt, the lender may reject your application.

- Property appraisal issues: If the property appraisal comes in lower than the agreed purchase price, the lender may not approve the loan.

- Failure to meet conditions: If you fail to meet the conditions set by the lender during pre-approval, such as providing additional documentation, the final approval may be denied.

Steps to Take After a Rejection

- Understand the reason for rejection: Contact the lender to understand why your application was rejected.

- Improve your financial situation: Work on improving your credit score, reducing debt, or increasing income before reapplying.

- Explore alternative options: Consider other lenders, different loan programs, or saving for a larger down payment.

Alternative Options After a Loan Rejection

- Seek a co-signer: If your credit or income is not strong enough, consider having a co-signer with better financial credentials.

- Build credit: Take steps to improve your credit score by making timely payments and reducing debt.

- Save for a larger down payment: Increasing your down payment can make you a more attractive borrower to lenders.

Final Review

In conclusion, differentiating between loan pre-approval and final approval is essential for making informed financial decisions. By grasping the nuances of each stage, borrowers can confidently progress towards securing their dream loan.