Looking to secure a USDA home loan? Dive into the details of eligibility, income requirements, property qualifications, and more in this comprehensive guide.

Learn how to navigate the application process, understand credit score criteria, manage debt-to-income ratio, and explore repayment options for your dream home.

Understand USDA Home Loans

USDA home loans are mortgages backed by the United States Department of Agriculture (USDA) that are designed to help individuals in rural areas purchase homes. These loans differ from conventional mortgages in that they require no down payment and offer lower interest rates.

Benefits of USDA Home Loans

- Zero down payment required, making homeownership more accessible.

- Lower interest rates compared to other loan options.

- No maximum purchase price, allowing for flexibility in choosing a home.

Eligibility for USDA Home Loans

- Must meet income requirements based on location and family size.

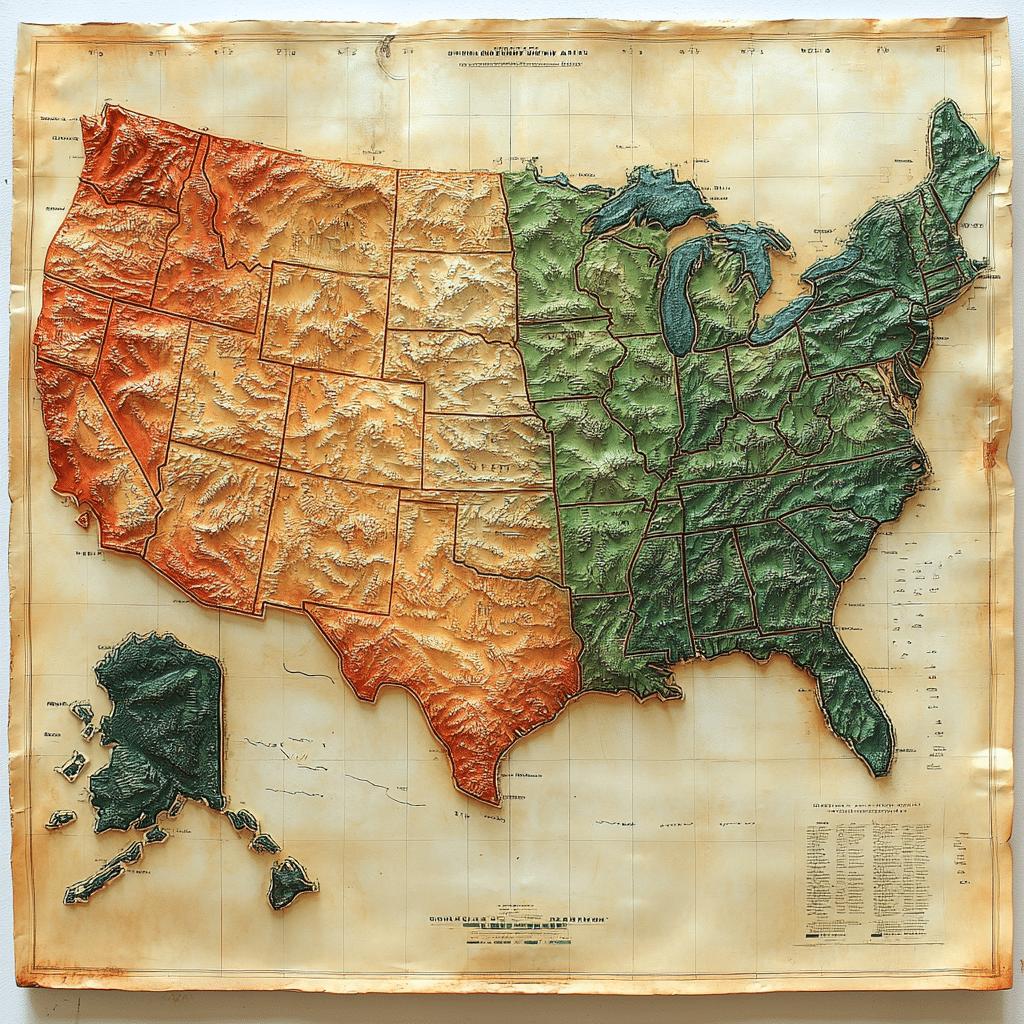

- Property must be located in a designated rural area as defined by the USDA.

- Borrower must be a U.S. citizen, non-citizen national, or qualified alien.

Properties that Qualify for USDA Home Loans

Properties eligible for USDA home loans must be located in rural areas as defined by the USDA. These can include single-family homes, townhouses, and condos.

Application Process for USDA Home Loans

- Complete a loan application with an approved lender.

- Provide documentation such as proof of income, employment history, and credit report.

- Wait for the lender to review the application and determine eligibility.

Interest Rates and Terms of USDA Home Loans

USDA home loans typically offer competitive interest rates and flexible terms. The interest rates vary but are generally lower than those of conventional mortgages, making them an attractive option for homebuyers.

Closing Costs of USDA Home Loans

Closing costs for USDA home loans are similar to those of other loan options. These costs can include appraisal fees, title insurance, and loan origination fees. However, USDA loans may offer options to roll some of these costs into the loan amount.

Income Requirements

To qualify for a USDA home loan, you must meet specific income requirements set by the USDA. Your income will be a crucial factor in determining your eligibility for this type of loan.

Overview of Income Limits

Income limits for USDA home loans are based on the area where you plan to buy a home and the number of people in your household. These limits are set to ensure that the program assists those in need of affordable housing.

- Income limits vary by location and family size

- Income includes not only wages but also retirement income, child support, and other sources

- Income limits are adjusted annually

Calculating Income for USDA Home Loan

When calculating your income for a USDA home loan, you will need to consider all sources of income that you receive. This includes your salary, bonuses, alimony, and any other income that you regularly receive.

It’s important to accurately calculate your income to ensure you meet the eligibility requirements for a USDA home loan.

- Include income from all household members

- Provide documentation for all income sources

- Consider any deductions or adjustments to your income

Property Eligibility

When applying for a USDA home loan, it is crucial to understand the property eligibility requirements to ensure a smooth approval process. The USDA has specific guidelines in place to determine which properties qualify for financing and which do not.

Types of Properties

- Single-family homes

- Condos

- Townhouses

- Modular homes

Property Location

- Properties located in rural areas are typically eligible for USDA financing.

- Properties in urban or suburban areas may not qualify.

- Check the USDA’s eligibility map to see if the property is in an approved location.

It is essential to ensure that the property is in an eligible location to avoid any delays in the loan approval process.

Comparison Table

| Properties Eligible for USDA Loans | Properties Not Eligible for USDA Loans |

|---|---|

| Located in rural areas | Located in urban or suburban areas |

| Single-family homes | Commercial properties |

| Condos | Vacation homes |

| Townhouses | Investment properties |

| Modular homes | Properties with income-producing features |

In a real-life scenario, a potential homebuyer found a perfect house but later discovered that it was located in an urban area, rendering it ineligible for USDA financing. This situation highlights the importance of verifying the property location before proceeding with the loan application.

Credit Score and History

When applying for a USDA home loan, your credit score and credit history play a crucial role in determining your eligibility. Lenders use this information to assess your financial responsibility and ability to repay the loan.

Minimum Credit Score Requirement

- The minimum credit score needed to qualify for a USDA home loan is typically around 640. However, some lenders may require a higher score.

Importance of Credit History

- Your credit history provides a snapshot of your financial behavior, showing how you have managed your debts and payments in the past.

- Lenders use this information to predict how likely you are to repay your loan on time. A positive credit history can increase your chances of loan approval.

Tips for Improving Credit Score

- Pay your bills on time every month to establish a positive payment history.

- Reduce your credit card balances to lower your credit utilization ratio.

- Avoid opening new credit accounts before applying for a USDA loan.

Impact of Late Payments

- Late payments can significantly lower your credit score and signal to lenders that you may be a risky borrower.

- Consistent on-time payments are essential to maintaining a good credit score.

Negative Marks on Credit Report

- Negative marks such as bankruptcies, foreclosures, and collections can negatively impact your credit score and jeopardize your USDA loan eligibility.

Comparison with Other Mortgage Loans

- USDA loans typically have more flexible credit score requirements compared to conventional or FHA loans.

- However, a higher credit score can still result in better loan terms and lower interest rates.

Obtaining a Free Credit Report

- You can obtain a free credit report from each of the three major credit bureaus once a year at AnnualCreditReport.com.

- Reviewing your credit report before applying for a USDA loan allows you to identify and address any errors or issues.

Disputing Errors on Credit Report

- If you find errors on your credit report that may impact your loan approval, you can dispute them with the credit bureau.

- Provide evidence to support your dispute and follow up to ensure the corrections are made.

Debt-to-Income Ratio

Understanding your debt-to-income ratio is crucial when applying for a USDA loan. This ratio plays a significant role in determining your eligibility and how much you can afford to borrow.

Calculating Your Debt-to-Income Ratio

Your debt-to-income ratio is calculated by dividing your total monthly debt payments by your gross monthly income. This ratio is expressed as a percentage and helps lenders assess your ability to manage monthly payments.

Debt-to-Income Ratio = (Total Monthly Debt Payments / Gross Monthly Income) x 100

Strategies for Lowering Debt-to-Income Ratio

- Pay off existing debts: Prioritize paying off high-interest debts to reduce your overall debt burden.

- Increase income: Consider taking on a part-time job or finding other sources of income to boost your gross monthly income.

- Reduce expenses: Cut back on unnecessary expenses to free up more money for debt payments and lower your debt-to-income ratio.

- Consolidate debts: Explore options for consolidating multiple debts into a single, lower-interest loan to simplify payments and reduce your monthly obligations.

Applying for a USDA Loan

To apply for a USDA home loan, you will need to follow a specific process and provide necessary documentation. This can be a crucial step in securing your dream home, so it’s essential to understand what is required and what to expect during the application review.

Documentation Needed for the Application

When applying for a USDA loan, you will need to gather important documents to support your application. This may include:

- Proof of income: Pay stubs, W-2 forms, or tax returns

- Proof of employment: Verification of employment or income

- Proof of assets: Bank statements, investment accounts, or other financial assets

- Credit history: Credit report and score

- Property information: Details about the home you intend to purchase

Having all the necessary documentation ready can help streamline the application process and increase your chances of approval.

What to Expect During the USDA Loan Application Review

Once you have submitted your application and all required documentation, the USDA loan application will undergo a thorough review process. During this time, you can expect:

- Verification of information: The lender will verify the information provided in your application and supporting documents.

- Property appraisal: An appraisal of the property will be conducted to determine its value and ensure it meets USDA guidelines.

- Underwriting process: The underwriter will assess your application to determine if you meet the eligibility criteria for a USDA loan.

- Approval or denial: Based on the review process, you will receive a decision on whether your USDA loan application has been approved or denied.

It’s important to stay in communication with your lender throughout the application review process and be prepared to provide any additional information or documentation as needed.

Loan Approval Process

When you apply for a USDA home loan, there are several steps involved in the approval process. Understanding these steps can help you navigate the process more smoothly and increase your chances of approval.

USDA Loan Approval Steps

- Submission of Application: The first step is to submit a complete application with all required documents.

- Initial Review: The USDA lender will review your application to ensure it meets all eligibility requirements.

- Property Appraisal: A professional appraisal of the property will be conducted to determine its value.

- Underwriting: The lender will assess your creditworthiness, financial situation, and the property’s eligibility for the loan.

- Loan Approval: If everything checks out, the lender will approve your loan application.

Approval Timeframe

Getting approved for a USDA loan typically takes around 30 to 60 days. The exact timeframe can vary depending on the lender’s workload and the complexity of your application.

Common Reasons for Denials

Common reasons for USDA loan application denials include insufficient income, poor credit history, and ineligible property.

To avoid these denials, make sure you meet all income requirements, maintain a good credit score, and choose a property that meets USDA guidelines.

Required Documents

- Proof of income (pay stubs, tax returns)

- Proof of identity (driver’s license, social security card)

- Proof of assets (bank statements, investment accounts)

- Property documents (purchase agreement, property appraisal)

Credit Score Requirements

To be eligible for a USDA loan, you typically need a credit score of 640 or higher. However, some lenders may accept lower scores with additional documentation or compensating factors.

Debt-to-Income Ratio

Your debt-to-income ratio is a crucial factor in the USDA loan approval process. It represents the percentage of your monthly income that goes towards paying debts. A lower ratio indicates a healthier financial situation and increases your chances of loan approval.

Interest Rates and Terms

When it comes to USDA home loans, understanding the interest rates and terms is crucial in determining the overall cost of the loan. Let’s take a closer look at how these factors can impact your home buying journey.

USDA Loan Interest Rates

USDA loan interest rates are typically competitive compared to other types of mortgages. These rates are influenced by various economic factors and can fluctuate over time. It’s essential to keep an eye on current interest rates to make an informed decision.

Loan Terms for USDA Home Loans

USDA home loans offer flexible loan terms to accommodate different financial situations. Borrowers can choose between various repayment periods, such as 15, 20, or 30 years. Selecting the right loan term can affect your monthly payments and overall interest costs.

Impact of Interest Rates and Terms

Interest rates and loan terms play a significant role in determining the total cost of your USDA home loan. Lower interest rates can result in lower monthly payments and reduced interest expenses over the life of the loan. On the other hand, longer loan terms may lead to lower monthly payments but higher overall interest costs. It’s essential to weigh the pros and cons of different interest rates and terms to find the best fit for your financial goals.

Mortgage Insurance

When obtaining a USDA home loan, mortgage insurance plays a crucial role in protecting the lender in case the borrower defaults on the loan. This insurance allows borrowers with less than 20% down payment to qualify for a loan with favorable terms.

Upfront and Annual Premiums

There are two types of mortgage insurance premiums associated with USDA loans – upfront and annual. The upfront premium is typically 1% of the loan amount and can be rolled into the loan. The annual premium is divided into monthly payments and is around 0.35% of the loan balance.

Managing Costs

- Improve Credit Score: A higher credit score can help lower the cost of mortgage insurance.

- Make a Larger Down Payment: Putting more money down upfront can reduce the amount of mortgage insurance required.

- Refinance: Once you reach 20% equity in your home, you can refinance to remove the mortgage insurance.

Repayment Options

When it comes to USDA home loans, there are different repayment options available to borrowers. Choosing the right repayment plan based on your financial situation is crucial to ensure you can comfortably make your monthly payments. Understanding the consequences of defaulting on a USDA loan and how to avoid it is also important to maintain a good financial standing.

Standard Repayment Plan

- With the standard repayment plan, you make fixed monthly payments over the life of the loan.

- This option is suitable for borrowers who prefer consistency in their monthly budget and can afford a slightly higher monthly payment.

- Defaulting on this plan can lead to negative consequences, including damage to your credit score and potential foreclosure.

Graduated Repayment Plan

- Under the graduated repayment plan, your monthly payments start lower and increase gradually over time.

- This option is ideal for borrowers who expect their income to rise in the future or those looking for lower initial payments.

- It is important to plan ahead and ensure you can afford the higher payments as they increase.

Income-Driven Repayment Plan

- Income-driven repayment plans adjust your monthly payments based on your income and family size.

- These plans are designed to help borrowers with lower incomes manage their loan payments effectively.

- It is crucial to provide accurate income information to qualify for this type of repayment plan.

Remember, defaulting on a USDA loan can have serious consequences, including damage to your credit score and potential foreclosure. It is essential to communicate with your lender if you experience financial difficulties to explore alternative repayment options and avoid default.

Down Payment Assistance

When purchasing a home with a USDA loan, you may be eligible for down payment assistance programs that can help you cover the upfront costs. These programs aim to make homeownership more accessible for individuals and families.

Options for Down Payment Assistance Programs

- State and local government programs

- Non-profit organizations

- Employer assistance programs

Eligibility Criteria and Application Process

Each down payment assistance program has its own set of eligibility requirements and application process. Typically, you will need to meet certain income limits and participate in homebuyer education courses. To apply, you will need to contact the specific program directly.

Benefits of Utilizing Down Payment Assistance

- Reduce the amount of money needed upfront

- Lower your overall loan amount

- Potentially qualify for a lower interest rate

Refinancing a USDA Loan

When it comes to refinancing a USDA loan, borrowers have the opportunity to take advantage of lower interest rates, reduce their monthly payments, or even access cash for other financial needs. Refinancing can be a smart financial move for those looking to improve their overall loan terms and save money in the long run.

Types of Refinancing

- Streamline Refinancing: This option allows borrowers to refinance their existing USDA loan with minimal documentation and paperwork, making the process quicker and more straightforward.

- Cash-Out Refinancing: With this option, borrowers can refinance their USDA loan for a higher amount than what is currently owed and receive the difference in cash.

Eligibility Criteria

- To qualify for USDA loan refinancing, borrowers must meet similar eligibility criteria as they did when initially applying for the loan. This includes having a good credit score, stable income, and meeting the USDA income and property eligibility requirements.

Potential Savings

- By refinancing a USDA loan, borrowers may experience lower monthly payments, reduced interest rates, or access to cash that can be used for home improvements or other financial goals.

- Comparing the current interest rates on the existing USDA loan with potential refinance rates can help borrowers understand the potential savings they could achieve through refinancing.

Refinancing Process

- The documentation needed for a USDA loan refinancing application may vary slightly from the initial loan application, so borrowers should be prepared to provide updated financial information and proof of income.

- Credit scores play a significant role in determining the terms of the refinance, so borrowers with higher credit scores may be eligible for better rates and terms.

- Knowing when the right time is to refinance a USDA loan can depend on market conditions, personal financial goals, and the potential savings that can be achieved through refinancing.

Closing Process

When it comes to closing on a USDA home loan, there are several important steps to follow to ensure a smooth and successful process. From scheduling the closing date to signing the final documents, here is a breakdown of what to expect during the closing process.

Scheduling the Closing Date

- Once your loan has been approved, your lender will work with you to schedule a closing date that works for all parties involved.

- It is important to choose a date that allows enough time for all necessary paperwork to be prepared and reviewed.

Reviewing and Signing Documents

- During the closing, you will be required to sign several important documents, including the promissory note, deed of trust, and closing disclosure.

- It is crucial to carefully review each document to ensure you understand the terms and conditions before signing.

Additional Costs and Fees

- At closing, there will be additional costs and fees to consider, such as closing costs, prepaid expenses, and escrow payments.

- Make sure to have the necessary funds available to cover these expenses on the closing day.

Preparing for Closing Day

- On the closing day, be sure to bring necessary identification, funds for closing costs, and any other items requested by your lender.

- Being prepared will help expedite the process and ensure a successful closing.

Timeline and Key Milestones

- The timeline for the closing process can vary, but it typically takes around 30-45 days from loan approval to closing.

- Key milestones include scheduling the closing date, reviewing and signing documents, and disbursing funds.

Post-Purchase Support

After successfully securing a USDA home loan and purchasing your dream home, it’s crucial to understand the available post-purchase support options to ensure a smooth homeownership experience. Whether you need assistance with managing your loan, resolving issues, or creating a budget plan, the USDA provides resources to help you navigate this new chapter in your life.

Applying for Post-Purchase Support

- Reach out to the USDA customer service team either by phone or online to inquire about post-purchase support options.

- Provide necessary information such as your loan details and specific concerns to receive personalized assistance.

- Follow the instructions provided by the customer service representative to access the appropriate resources for your needs.

Role of Customer Service

- Customer service plays a crucial role in assisting homeowners with USDA loans in resolving any issues or concerns they may encounter.

- They provide guidance on loan management, repayment options, and other related inquiries to ensure homeowners stay on track with their financial obligations.

- Customer service representatives are trained to address various homeowner concerns promptly and effectively, offering solutions tailored to individual situations.

Accessing Online Resources

- Visit the official USDA website and navigate to the homeowner resources section to access a wealth of information on managing your USDA loan.

- Utilize online tools and calculators provided by the USDA to track your loan payments, estimate future costs, and plan your budget effectively.

- Explore educational materials, FAQs, and guides available online to enhance your understanding of homeownership responsibilities and best practices.

Creating a Budget Plan

- Develop a comprehensive budget plan that takes into account your monthly expenses, loan payments, and savings goals to maintain financial stability.

- Allocate funds for essential expenses, such as mortgage payments, utilities, insurance, and maintenance costs, while setting aside savings for emergencies.

- Regularly review and adjust your budget plan to reflect changes in your financial situation or unexpected expenses that may arise during homeownership.

Importance of Timely Payments

- Timely payments are essential to maintain financial stability and avoid defaulting on your USDA loan, which could lead to foreclosure.

- Make it a priority to submit your monthly payments on time to build a positive credit history and demonstrate financial responsibility to lenders.

- Consider setting up automatic payments or reminders to ensure you never miss a due date and stay on top of your financial commitments.

Wrap-Up

From understanding USDA home loans to post-purchase support, this guide equips you with the knowledge needed to make informed decisions and achieve your homeownership goals.