How Loan Origination Fees Work and How to Negotiate Them sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with formal and friendly language style and brimming with originality from the outset.

Understanding the intricate details of loan origination fees and mastering negotiation tactics can significantly impact your borrowing experience. Let’s delve into the world of loan origination fees and uncover the secrets to negotiating them effectively.

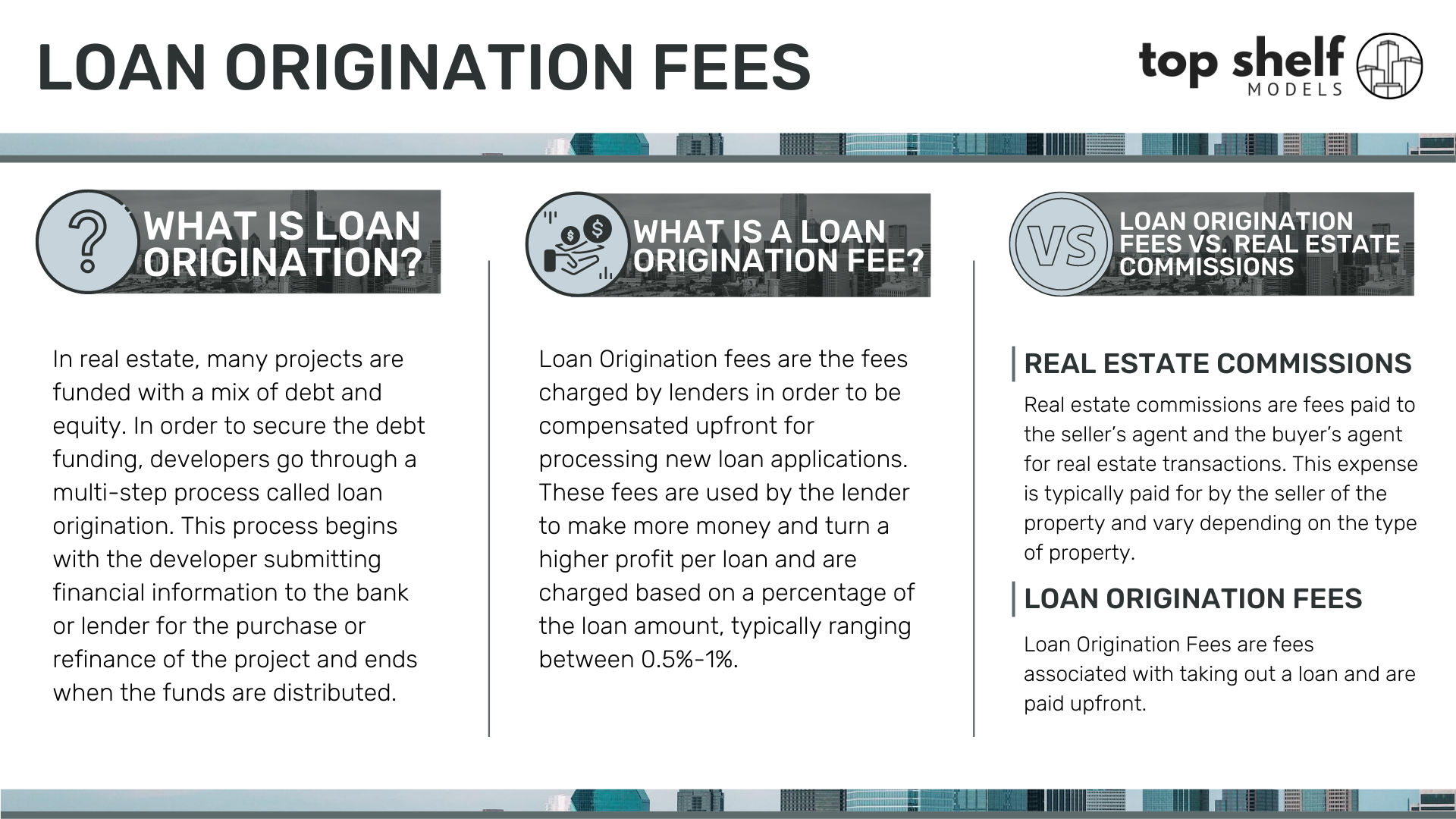

Understanding Loan Origination Fees

Loan origination fees are charges imposed by lenders to cover the costs associated with processing a loan application and disbursing funds to borrowers. These fees are typically expressed as a percentage of the total loan amount and are usually paid upfront at the time of closing.

Purpose of Loan Origination Fees

Loan origination fees serve as compensation for the lender’s services in evaluating, processing, and approving a loan application. These fees help cover the administrative costs, such as credit checks, underwriting, and documentation preparation, involved in the lending process.

- Application Fee: A flat fee charged to cover the initial costs of processing the loan application.

- Processing Fee: A fee to cover the administrative costs of verifying information, assessing creditworthiness, and preparing the loan for approval.

- Underwriting Fee: A fee for the lender’s evaluation of the borrower’s credit risk and determination of loan approval.

Difference from Interest Rates

Loan origination fees are distinct from interest rates, which represent the cost of borrowing money over time. While interest rates determine the amount of interest charged on the loan balance, loan origination fees are one-time charges that borrowers pay to initiate the loan process. It’s essential to consider both the interest rate and origination fees when evaluating the overall cost of borrowing.

Factors Affecting Loan Origination Fees

When it comes to loan origination fees, several key factors come into play that can influence the amount you end up paying. These factors can vary depending on the lender and your specific financial situation. Understanding these factors is essential when negotiating loan origination fees to ensure you are getting the best deal possible.

Credit Scores Impact

Your credit score plays a significant role in determining the loan origination fees you are charged. Lenders use credit scores to assess the risk of lending to you. Generally, borrowers with higher credit scores are considered less risky, and they may be offered lower origination fees. On the other hand, borrowers with lower credit scores may face higher origination fees to offset the perceived risk.

Loan Amount and Type

The loan amount and type of loan you are applying for can also impact the origination fees. Larger loan amounts typically result in higher origination fees since lenders are taking on more risk by lending you a larger sum of money. Additionally, different types of loans, such as conventional loans, FHA loans, or VA loans, may have varying origination fees based on the specific requirements and regulations associated with each loan type.

Different Lenders Calculation

It’s important to note that different lenders may have varying methods for calculating loan origination fees. Some lenders may charge a flat fee, while others may calculate origination fees as a percentage of the loan amount. Additionally, some lenders may offer the option to pay points to lower the origination fees or interest rate. It’s crucial to compare offers from multiple lenders to ensure you are getting the best deal on loan origination fees based on your financial situation and needs.

Calculating Loan Origination Fees

When obtaining a loan, it is essential to understand how loan origination fees are calculated to ensure transparency and avoid any surprises. These fees can significantly impact the overall cost of borrowing, so it’s crucial to know how they are determined.

Step-by-Step Guide

- Start by identifying the loan amount you are borrowing from the lender.

- Next, determine the percentage rate that the lender charges as the origination fee.

- Multiply the loan amount by the origination fee percentage to calculate the total origination fee.

Hidden Costs

Loan origination fees may sometimes include hidden costs such as application fees, administrative fees, or processing fees. It’s essential to review the loan agreement carefully to identify any additional charges that may be included in the origination fees.

Variability Based on Lender’s Policies

Loan origination fees can vary based on the lender’s policies, the type of loan, creditworthiness of the borrower, and other factors. Some lenders may have fixed origination fees, while others may calculate fees based on a percentage of the loan amount. It’s essential to shop around and compare offers from different lenders to find the most favorable terms.

Legal Regulations

There are legal regulations in place that require lenders to disclose loan origination fees and any other associated costs to borrowers. The Truth in Lending Act (TILA) mandates that lenders provide a Loan Estimate outlining all costs associated with the loan, including origination fees. This transparency allows borrowers to make informed decisions and understand the total cost of borrowing.

Negotiating Loan Origination Fees

When it comes to negotiating loan origination fees, there are several strategies you can use to potentially lower the costs and save money. It’s essential to be proactive and assertive in discussing these fees with lenders to secure the best deal possible. Here are some tips to help you negotiate more favorable terms.

Comparing Offers from Multiple Lenders

Before committing to a loan from a single lender, make sure to shop around and compare offers from multiple sources. This will give you a better understanding of the market rates and fees, allowing you to leverage this information during negotiations. By presenting competitive offers, you can show lenders that you have options and may encourage them to offer more competitive terms.

Leveraging Your Creditworthiness

Your credit score and financial history play a significant role in determining the fees and interest rates you are offered. If you have a strong credit profile, use this to your advantage during negotiations. Highlight your creditworthiness to lenders as a reason to consider lowering origination fees. Lenders may be more willing to negotiate fees with borrowers who present less risk.

Asking for a Waiver or Reduction in Fees

In some cases, it may be appropriate to directly ask lenders for a waiver or reduction in origination fees. If you have a strong relationship with the lender or are a repeat customer, they may be more inclined to accommodate your request. Additionally, if you are willing to commit to a larger down payment or a longer loan term, lenders may be willing to adjust the fees to secure your business.

Transparency in Loan Origination Fees

Transparency in disclosing loan origination fees is crucial for borrowers to fully understand the costs associated with obtaining a loan. Lenders should clearly communicate origination fees to borrowers to ensure they are aware of all the charges involved in the loan process. This transparency helps borrowers make informed decisions and avoid any surprises during the loan repayment period.

Importance of Transparency

Transparency in loan origination fees ensures that borrowers are fully aware of all the costs involved in obtaining a loan. Lenders should provide a breakdown of all fees, including origination fees, so that borrowers can make accurate comparisons between different loan offers.

Examples of Clear Communication

- Lenders should clearly state the origination fee amount in the loan estimate provided to the borrower.

- Explanations of what the origination fee covers should be included in the loan documentation.

- Disclosure forms should outline any potential changes to the origination fee during the loan process.

Benefits for Borrowers

Transparency in loan origination fees benefits borrowers by allowing them to budget effectively and understand the total cost of borrowing. When borrowers have a clear understanding of the fees involved, they can negotiate better loan terms and avoid any hidden charges.

Consumer Protection Laws

- The Truth in Lending Act (TILA) requires lenders to disclose all fees associated with a loan, including origination fees, in a clear and understandable manner.

- The Consumer Financial Protection Bureau (CFPB) oversees and enforces regulations related to loan origination fee disclosures to protect borrowers from unfair practices.

Common Misconceptions about Loan Origination Fees

Loan origination fees can be a confusing aspect of the lending process, leading to several common misconceptions. Let’s debunk some of these myths to empower borrowers with accurate information.

Origination Fees Are Unnecessary Additional Costs

There is a misconception that loan origination fees are unnecessary charges imposed by lenders to increase their profits. In reality, origination fees are legitimate fees charged by lenders to cover the costs of processing a loan application and securing funding for the borrower.

Origination Fees Are Calculated Arbitrarily

Some borrowers believe that lenders calculate origination fees arbitrarily, without any basis or transparency. However, origination fees are typically calculated as a percentage of the total loan amount, ranging from 0.5% to 1% of the loan principal. Lenders are required to disclose these fees upfront to borrowers.

Origination Fees Cannot Be Negotiated

Another common misconception is that origination fees are set in stone and cannot be negotiated. In reality, borrowers can negotiate origination fees with lenders, especially if they have a strong credit history and are deemed low-risk borrowers. It is essential for borrowers to advocate for themselves and explore the possibility of reducing or waiving origination fees during the loan application process.

Origination Fees Are All Profit for Lenders

Some borrowers believe that origination fees represent pure profit for lenders. While lenders do generate revenue from origination fees, these fees primarily cover the expenses associated with processing loans, such as administrative costs, underwriting fees, and credit checks. Understanding the breakdown of origination fees can help borrowers differentiate between legitimate costs and excessive charges.

Impact of Loan Origination Fees on Overall Loan Cost

Loan origination fees can significantly impact the total cost of borrowing money. These fees are typically charged by lenders to cover the cost of processing a loan application and are usually calculated as a percentage of the total loan amount.

Contributing Factors to Overall Loan Cost

- Origination fees are added to the principal amount of the loan, increasing the total amount borrowed.

- These fees are typically paid upfront or rolled into the loan, resulting in higher monthly payments and more interest paid over the life of the loan.

- Higher origination fees can lead to a higher annual percentage rate (APR), making the loan more expensive overall.

Scenarios Where Higher Origination Fees May Be Justified

- In some cases, paying higher origination fees may result in a lower interest rate, reducing the overall cost of borrowing.

- For borrowers who plan to stay in their home or keep the loan for an extended period, paying higher fees upfront may be beneficial in the long run.

- Comparing the total cost of different loan options, including origination fees, can help borrowers make an informed decision.

Tips for Minimizing the Impact of Origination Fees

- Negotiate with lenders to reduce or waive origination fees, especially if you have a strong credit history or are a repeat customer.

- Consider shopping around and comparing offers from different lenders to find the best terms and lowest fees.

- Avoid rolling origination fees into the loan amount, as this will increase the total cost of borrowing.

Comparing Origination Fees with Other Loan Expenses

- Origination fees are just one of many expenses associated with taking out a loan, including appraisal fees, title insurance, and closing costs.

- While origination fees can have a significant impact on the total cost of borrowing, it’s essential to consider all associated expenses when evaluating loan options.

- Understanding the breakdown of costs and fees can help borrowers make a well-informed decision and choose the most cost-effective loan option.

Alternatives to Traditional Loan Origination Fees

When it comes to borrowing money, traditional loan origination fees are not the only option available. Lenders may offer alternative fee structures that can be more cost-effective for borrowers. Let’s explore some innovative ways that lenders may structure fees instead of traditional origination fees, along with the pros and cons of each.

Flat Fee Structure

Some lenders may offer a flat fee structure where borrowers pay a set amount for the origination of the loan, regardless of the loan amount. This can be beneficial for borrowers seeking predictability in their upfront costs.

Percentage-Based Fee

Another alternative is a percentage-based fee, where borrowers pay a percentage of the loan amount as the origination fee. While this may result in higher fees for larger loans, it could be more affordable for smaller loan amounts.

No-Fee Loans

Some lenders may offer no-fee loans, where they do not charge any origination fees upfront. Instead, they may recoup these costs through slightly higher interest rates over the life of the loan. This can be advantageous for borrowers who prefer to spread out their costs.

Points System

Another alternative fee structure is a points system, where borrowers have the option to pay discount points upfront to lower their interest rate. This can be a strategic way for borrowers to save money on interest payments over time.

Comparing Traditional vs. Alternative Fee Models

While traditional origination fees offer a straightforward way for lenders to recoup costs, alternative fee structures provide borrowers with more flexibility and potentially lower upfront costs. However, borrowers should carefully consider the long-term implications of each fee model to determine which option is the most cost-effective for their individual financial situation.

Case Studies on Loan Origination Fees

Loan origination fees can have a significant impact on borrowers, affecting the overall cost of a loan. By examining real-life examples, we can gain insights into how these fees influence borrowers and how negotiation strategies can play a role in reducing origination fees.

Case Study 1: Negotiation Strategies

- One borrower successfully negotiated a lower loan origination fee by presenting competitive offers from other lenders.

- By demonstrating the ability and willingness to take their business elsewhere, the borrower was able to convince the lender to reduce the origination fee.

- The negotiation tactic of shopping around and leveraging multiple offers proved effective in securing a better deal on loan origination fees.

Case Study 2: Impact on Borrowers

- In another case, a borrower initially accepted the lender’s origination fee without questioning or negotiating.

- As a result, the borrower ended up paying a higher origination fee compared to similar loans in the market.

- This example highlights the importance of being proactive in negotiating loan origination fees to avoid overpaying.

Case Study 3: Successful Negotiation Tactics

- A borrower successfully negotiated a reduction in the loan origination fee by highlighting their strong credit history and financial stability.

- By demonstrating lower risk to the lender, the borrower was able to secure a lower origination fee, ultimately saving money on the loan.

- This case underscores the impact of borrower characteristics and financial profile on negotiating favorable terms for loan origination fees.

Case Study 4: Outcomes of Negotiation

- Several borrowers who engaged in negotiation tactics were able to reduce their loan origination fees significantly.

- By advocating for themselves and exploring different options, these borrowers achieved more favorable terms and lower costs on their loans.

- The outcomes of successful negotiations highlight the importance of being proactive and informed when dealing with loan origination fees.

Future Trends in Loan Origination Fees

The landscape of loan origination fees is constantly evolving, influenced by various factors such as market conditions, regulatory changes, and advancements in technology. As we look ahead, it is essential to consider how loan origination fees may shape the borrowing experience for consumers and the strategies adopted by lenders.

Evolution of Loan Origination Fees

- With the rise of online lending platforms and fintech companies, traditional banks and financial institutions may face pressure to be more competitive in their fee structures.

- Lenders could explore innovative fee models, such as performance-based fees or subscription-based services, to attract borrowers and differentiate themselves in the market.

- There might be a shift towards more transparent and simplified fee disclosures to enhance consumer trust and compliance with regulatory requirements.

Impact of Technology on Transparency

- Advancements in technology, such as artificial intelligence and blockchain, could streamline the loan origination process and reduce costs, potentially leading to lower origination fees for borrowers.

- Digital platforms may offer tools and calculators that allow borrowers to compare loan offers more easily, promoting transparency in fee structures and empowering consumers to make informed decisions.

Recommendations for Borrowers

- Stay informed about the latest trends in loan origination fees by following industry news, attending financial education workshops, and consulting with financial advisors.

- Compare loan offers from multiple lenders to understand the range of origination fees and negotiate with lenders to potentially lower or waive certain fees based on your creditworthiness and financial situation.

- Be proactive in asking lenders about any hidden fees or charges that may impact the overall cost of borrowing, and seek clarification on fee structures before committing to a loan agreement.

Last Recap

As we conclude this exploration of loan origination fees and negotiation strategies, it becomes evident that informed borrowers hold the power to make sound financial decisions. By understanding the dynamics of origination fees and honing your negotiation skills, you pave the way for a more favorable borrowing journey.